Setting up payroll

Last updated Saturday, December 13, 2025

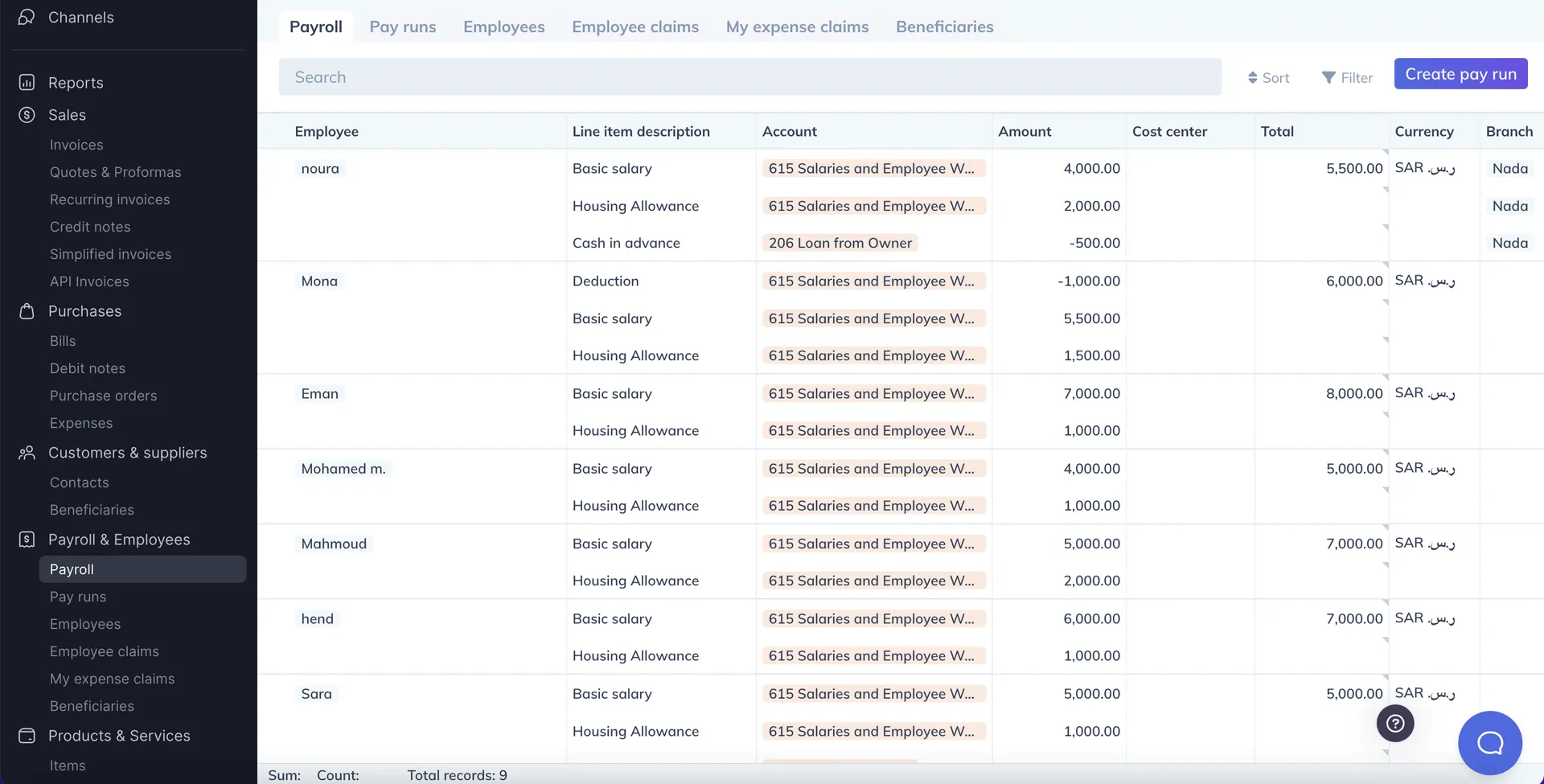

Learn how to easily manage employee salaries with Wafeq Payroll.

How does Payroll work in Wafeq?

The Payroll feature allows you to:

- List all your employees and their salaries.

- Create payslips and send them to your employees.

- Break down the types of payroll expenses (e.g. Housing, Basic Salary, Transporation, GOSI, etc.)

- Reimburse employee expense claims during the payroll cycle.

Step-by-step instructions

Set up payroll

- Go to

Payrollin the lef-side menu - On the Payroll sheet, list your employees, their pay items (e.g. Basic Salary, Housing) and the amounts of each pay item.

- In the

Include in pay run, chooseYes

Payroll is now ready and will serve to generate payslips for each payroll period.

Run payroll

Whenever you'd like to run payroll:

- Go to

Payrollin the lef-side menu. - Make sure

Include in pay runis set toYesfor employees you'd like to include in this pay run. - Click

Create pay run. - Draft payslips will be created for each employee.

- Set the

Period startdate, which is the date you'd like the salaries to be expenses. - Change the status to

POSTEDtoo book the salaries as expenses. Once you do that, your Profit & Loss statement will be updated.

Pay payroll

When you pay your employees:

- Go to the

Pay runsin the lef-side menu. - For each payslip, click the

+button under thePaymentscolumn. - Record a payment

Send payslips

To send payslips to your employees:

- Make sure each employee has an email address by going to the

Employeespage on the left-side menu. - Go to the

Pay runspage on the left-side menu - Check the boxes next to each payslip you'd like to send

- Click

Send payslipsin the top right corner - You will get a preview of the payslips to be sent

- Click

Sendto send the payslips.

Draft payslips

You cannot send payslips in DRAFT status. You can only send payslips that are in status POSTED or PAID.

![New Product Features [March-2023]](https://firebasestorage.googleapis.com/v0/b/wafeq-docs.appspot.com/o/medias%2Fd68397dc_Help Center - EN Article Cover-22.png?alt=media)

.png?alt=media)