Chart of accounts

What is Accounts Payable?

Accounts payable is a critical aspect of any business's financial operations, particularly in dynamic and diverse markets. This article will provide an in-depth look into what accounts payable is, how it operates, and its relevance in the Saudi context.

What are Accounts Payable?

Accounts payable (AP) represents the amounts that a company owes to its suppliers for goods or services purchased on credit. These obligations are typically due within a short-term period and are considered liabilities on a company's balance sheet.

How is the Balance of Accounts Payable Determined?

The balance of accounts payable is influenced by several factors:

Purchasing Goods or Services: When a company in Saudi Arabia purchases goods or services on credit, the accounts payable balance increases by the invoiced amount.

Payment to Suppliers: Paying an invoice to a supplier decreases the accounts payable balance by the amount of the payment.

Receiving Credit Notes: If a supplier issues a credit note for a return or discount, the accounts payable balance decreases by the credit note's amount.

Balance Sheet Implications

Accounts payable is listed on the balance sheet as a current liability, reflecting the company's short-term obligations. Managing accounts payable efficiently is essential to maintain good relationships with suppliers and ensure steady cash flow.

The Importance of Accounts Payable

- Cash Flow Management: Efficient accounts payable (AP) management helps to predict and control the cash flow, crucial for making sound financial decisions.

- Vendor Relationships: Timely and accurate payment to suppliers fosters good relationships, crucial for successful negotiations and obtaining favorable credit terms.

- Compliance and Reporting: Proper AP processes ensure adherence to regulatory requirements and facilitate accurate financial reporting, helping to avoid legal complications and enhance transparency.

- Cost Savings: By taking advantage of early payment discounts or avoiding late fees, companies can achieve significant cost savings.

- Strategic Use of Capital: AP management enables companies to make strategic decisions about when and how to pay, allowing for optimal use of capital and investment opportunities.

Example from Wafeq

Purchase Order Creation: A user within Wafeq initiates a purchase order, detailing the required goods or services.

Invoice Matching: Upon receiving the goods or services, the user can verify and match the invoice with the original purchase order within Wafeq's streamlined interface.

Entry and Approval: The invoice is entered into Wafeq, where it's categorized under accounts payable.

Payment Scheduling: Wafeq allows for automated payment scheduling, adhering to the vendor's terms, and the payment is executed through the user's preferred method.

Reconciliation and Reporting: Payments are automatically reconciled in Wafeq, and real-time reporting is available for tracking all accounts payable activities.

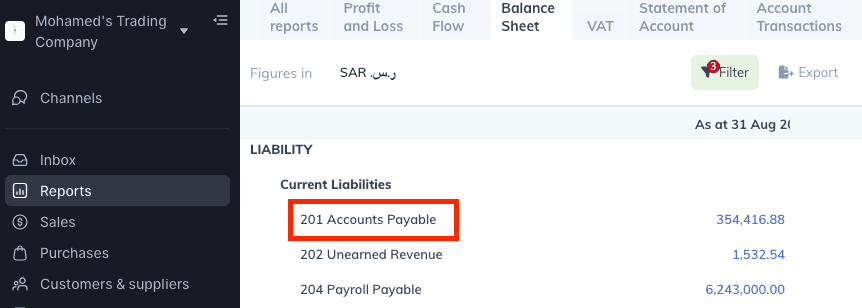

You can find Accounts Payable under Current Liabilities from Reports.

You can find Accounts Payable under Current Liabilities from Reports.

Conclusion

Accounts payable plays a pivotal role in the financial management of companies. Understanding and efficiently managing this aspect of finance is essential for compliance, relationship building, and financial stability. Tools like Wafeq, designed to suit the unique challenges of the Saudi market, can significantly enhance accounts payable management, driving success and growth in various industry sectors. Whether a small startup or a large enterprise, the principles of accounts payable remain consistent, shaping the financial landscape.