Branches

Creating and Managing Branches in Wafeq

Creating a Branch in Wafeq

Wafeq offers two methods to create and manage branches:

- Directly from the Branches page

- Through a contextual dropdown within a document creation page (like invoices or quotes)

From the Branches Page

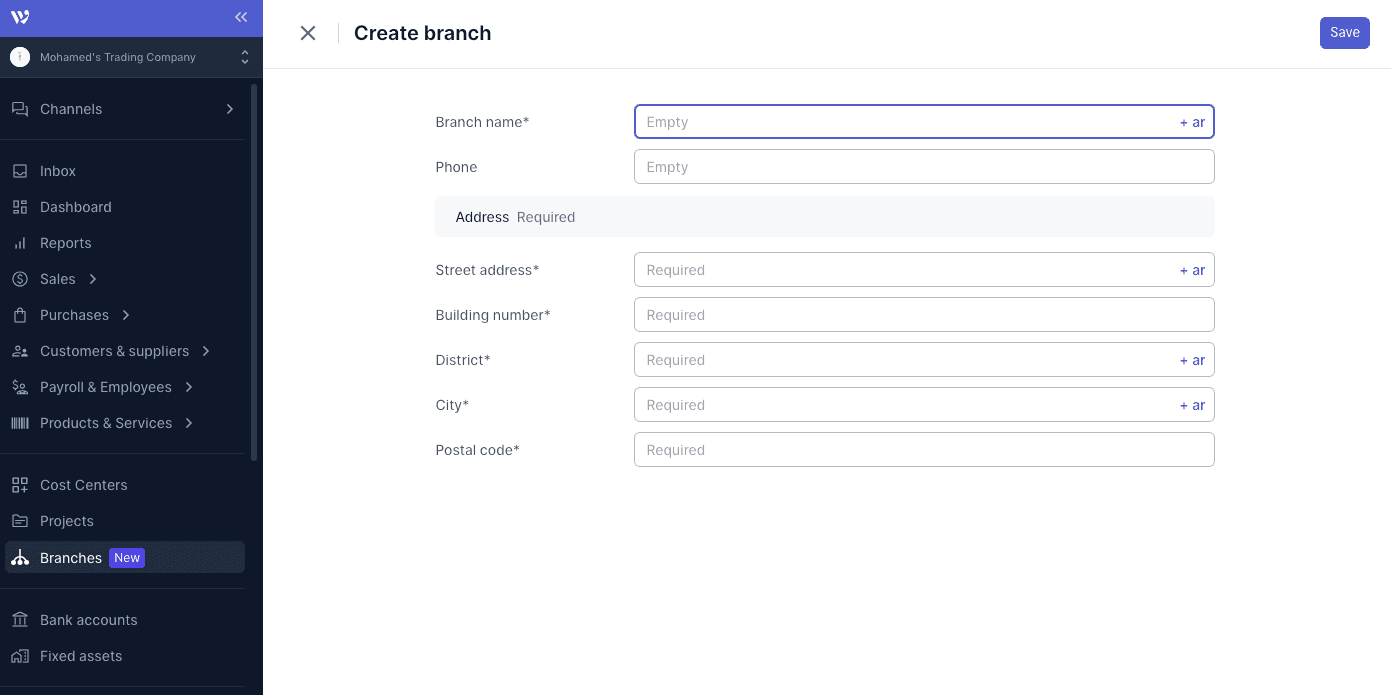

Create a Branch

- Navigate to

Branchesfrom the main side menu. - Select

Addto initiate a new branch. - Fill in the branch details, including its unique

Commercial Registration (CR)number, under the main company's CR. - Click

Saveto complete the setup.

Edit a Branch

- To edit, go to the

Branchessection, select a branch, and modify details on theEdit Branchpage.

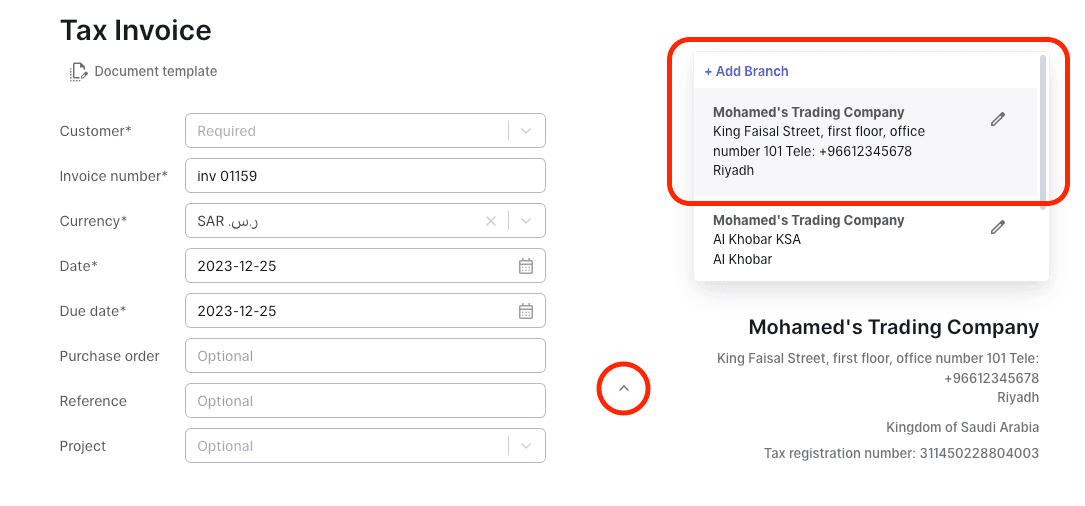

Via Contextual Menu

Create a Branch

- When generating a document (invoice, quote, etc.), click on your organization's name to access a dropdown.

- Choose

Add Branchfrom the menu and enter the branch's details, including its unique CR. - Click

Saveto proceed.

Edit a Branch

- In any document creation process, select your organization's name to open the dropdown.

- Use the

pencil iconnext to a branch's name to edit. - Update as needed and save the changes.

Using the Branch

- The newly created branch can be assigned to various transactions like invoices, quotes, and more, from the dropdown below your organization's details on the Create/Edit page.

Managing Inactive Branches

Inactive branches won't appear in the dropdown for document issuance. Also, generating reports for an inactive branch is not possible.

Distinguishing Between a Branch and a New Organization

Below are some cases to help you better set up your organizations and branches inside Wafeq:

Different Countries/Tax Authorities:

Requires setting up two organizations.

Separate VAT Numbers:

Treat as different organizations within Wafeq.

Same VAT, Different CR Numbers:

- For KSA: Use as a branch if not a VAT group. If it's a VAT group, set up as separate organizations.

- For Non-KSA: The entity can be set up as a branch.

Understanding VAT Groups (KSA Only)

A VAT group allows multiple main companies to share a single VAT group number. It's recognizable by the '1' in the 10th digit of the VAT number.