What is Phase 2 of KSA e-invoicing

Saudi Arabia is diligently working towards the implementation of its ambitious Vision 2030 plan, with the digital transformation of invoicing systems being one of its key objectives and future projects. Especially after Saudi Arabia took its first steps in this field by merging the Zakat, Tax, and Customs Authority with the General Authority for Zakat and Income, along with the successful completion of the first phase of e-invoicing. To know everything about the second phase of electronic invoicing, its importance, requirements, and operation mechanism, continue reading the article.

Introduction to Electronic Invoicing

Until the end of the twentieth century, paper invoices were the traditional method used to document the payment process between two parties, through direct manual means such as checks, until the development of the electronic payment idea with the growth of the banking services sector and the entrance of computers and the internet into all aspects of our lives.

Electronic invoicing is defined as a procedure aimed at transforming the process of issuing paper invoices and notices into an electronic process that allows for the exchange, issuance, and processing of debtor and creditor invoices and notices in an organized electronic format between the seller and buyer in an integrated electronic format. Saudi Arabia began building the operational model and the legal framework for the electronic invoicing regulation in September 2020.

On December 4th, 2020, the electronic invoicing regulation was published for the first time, followed by the publication of the implementation rules and provisions of the regulation on May 28th, 2021. Until the Kingdom entered the issuance and preservation phase on December 4th, 2021, known as the first phase of electronic invoicing. Taxpayers are required to create and store tax invoices, cash tax invoices, and related debtor and creditor notices, ensuring that all electronic invoices include all the required elements according to the type of invoice.

Learn more about e-invoicing Terms for Saudi Arabia.

What is the Second Phase of Electronic Invoicing?

The second phase of electronic invoicing is called the integration and linking phase. The Zakat, Tax, and Customs Authority named it so because it involves linking the systems for issuing electronic debtor and creditor invoices and notices of taxpayers with the systems of the Zakat, Tax, and Customs Authority, according to the stipulated provisions and conditions, and integrating them to share data and information.

The second phase will be implemented in several stages starting from January 1, 2023, as agreed, with the targeted taxpayers being notified of the linking process at least 6 months before the scheduled date. The regulating authority published the required standards on June 24, 2022, and informed VAT taxpayers with revenues exceeding 3 billion Saudi riyals of the necessity to implement the second phase of electronic invoicing on the specified date.

Visit our ZATCA e-invoicing Phase 2 page.

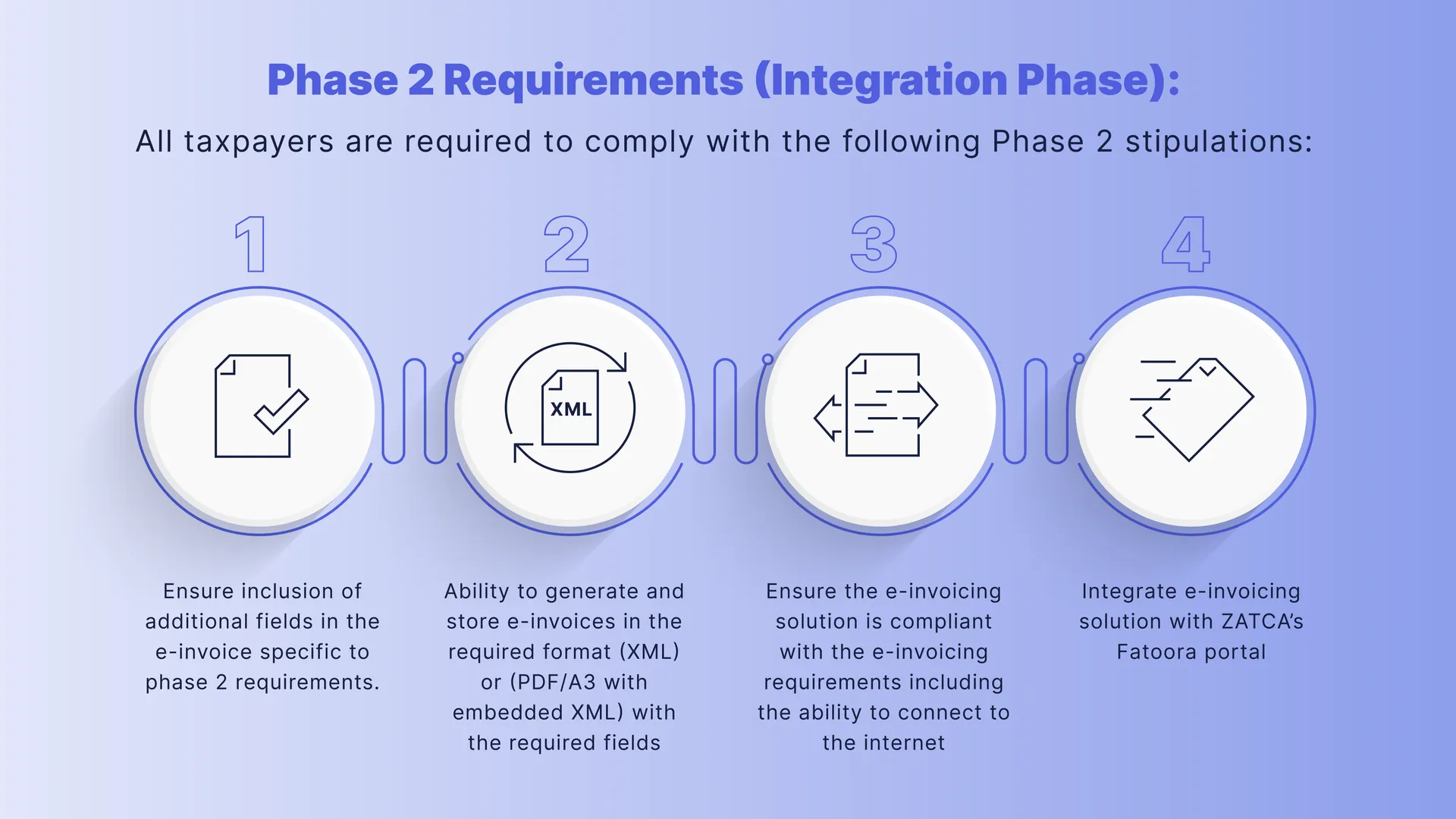

Requirements of the Second Phase of E-Invoicing

All electronic invoices and notifications must be issued in a format that meets the following requirements and details:

You can navigate to the electronic invoice guide page to download all the instructions.

Electronic Invoice Issuance Systems Requirements:

Electronic invoices, whether they are tax invoice or a simplified tax invoice and their associated notifications, must be issued electronically in a format that includes all the required details and fields for each, in either XML or PDF-A3 format (including an XML format).

Electronic invoices and associated electronic notifications must contain additional fields including a cryptographic stamp (an electronic seal created by encrypted algorithms to ensure the reliability and safety of the data of electronic invoices and associated electronic notifications and to verify the identity of their issuer, ensuring compliance with the provisions and controls of the VAT system and its executive regulation) starting from the date specified by the Zakat, Tax, and Customs Authority.

Cash tax invoices and related tax notifications (Reporting) must be sent to the authority within a period not exceeding 24 hours from the date of issuance according to the mechanism specified by the authority.

Electronic invoices must be archived and stored according to the provisions of the VAT system and its executive regulation.

Technical Solution Requirements:

- The technical solution used in issuing electronic invoices and notifications must comply with the specifications and requirements outlined in the electronic invoicing regulation, with the authority verifying compliance either through a third party or self-verification by the person subject to the electronic invoicing regulation based on the verification mechanism and requirements defined by the authority.

- The technical solution must be capable of issuing each electronic invoice or notification in XML or PDF-A3 format (including an XML format).

- The invoice must be approved on the authority's platform in real-time for accreditation (API) through the application programming interface.

- Those subject to the electronic invoicing regulation must share the tax invoice or the related notification issued electronically with their customers.

- They must also provide a printed copy of the cash tax invoice or the related notification, and it may also be shared in its electronic format or any other format that can be read normally by customers.

- The technical solution must include a counter for electronic invoices and notifications and must be capable of connecting to the internet.

Data Security Requirements:

- The technical solution must be tamper-proof and include a mechanism to prevent and detect any tampering attempts to ensure data and information security.

- It must be capable of generating a globally unique identifier (UUID), in addition to a serial number that distinguishes each tax invoice, cash tax invoice, and associated notifications.

- It must be able to create a cryptographic stamp and a specific cryptographic stamp identifier, generate a hash function for each electronic invoice or notification, and generate a type of barcode in the form of a matrix readable by a QR code scanner.

Start with Wafeq

Start with Wafeq

Wafeq fully complies with all requirements set by the Zakat, Tax, and Customs Authority, offering advanced features and options that help organize all your accounting tasks.

How Does Electronic Invoicing Work in the Second Phase?

There are two main types of electronic invoicing depending on the type of invoice. Below, we discuss the operating principle of each:

For cash tax invoices typically issued between an establishment and a consumer:

- - The seller issues the electronic invoice to the customer, including all elements of the cash tax invoice.

- - The seller delivers the invoice to the buyer.

- - The seller electronically saves the invoice.

- - The seller shares the invoice with the authority within a timeframe not exceeding 24 hours in an automated manner by connecting their technical solution to the “Fatoora” platform.

For tax invoices typically issued between establishments:

- - The seller issues the electronic invoice including all elements of the tax invoice.

- - The seller shares the invoice with the Zakat, Tax, and Customs Authority through electronic linking for approval by the authority, and the approved invoice is sent back to the seller electronically.

- - The seller shares the electronically approved invoice with the buyer in a readable format.

- - The seller electronically saves the invoice.

Software Development Tools for E-Invoicing

The Zakat, Tax, and Customs Authority (ZATCA) has developed a set of Software Development Kits (SDK) to assist those subject to the electronic invoicing regulation in verifying the compliance of electronic invoices and associated debtor and creditor notifications with the electronic invoicing regulation requirements and laws in Saudi Arabia.

SDKs are defined as compliance and enablement tool programs that can be downloaded without an internet connection and used to validate XML-based electronic invoices or creditor and debtor notification files by the requirements, standards, and guidelines published in the ZATCA electronic invoicing regulation. These tools also allow for QR code validation according to the specified structure and the possibility of integrating their EGS units with an offline local SDK.

Importance of the Electronic Invoicing System

Saudi aims to start implementing the second phase of electronic invoicing due to its importance and positive impact on the digital economy in the Kingdom, including:

- - Facilitating procedures for clients and saving a lot of time and effort.

- - Working with greater accuracy and quickly detecting attempts at manipulation and fake invoices.

- - Enhancing the principle of absolute transparency in transactions among all citizens in Saudi Arabia.

- - Unifying the mechanism for documenting and auditing invoices, which helps companies, individuals, and the government work more efficiently.

- - Diversifying the sources of building the Saudi economy and not relying solely on oil and petroleum products as a primary source.

- - Eliminating the need for paper transactions and their disposal, meaning that electronic invoicing is environmentally friendly.

- - Significantly reducing administrative expenses.

If you have received a notification from the authority for the second phase, contact us at help@wafeq.com or 8001110601 to help you adjust your account on "Wafeq" according to the requirements of the second phase.

If you have received a notification from the authority for the second phase, contact us at help@wafeq.com or 8001110601 to help you adjust your account on "Wafeq" according to the requirements of the second phase.

FAQs About the Second Phase of Electronic Invoicing

How can I find out when the second phase will be applied to my establishment, given that it will be implemented in batches?

The second phase will not be implemented before January 1, 2023. The authority will notify the targeted categories in each phase at least six months before the scheduled connection date.

What is the compliance verification program via the platform for non-technical users?

This program is directed at non-technical users who have access to an electronic invoice in XML format a creditor or debtor notification or a binary file for a QR code using a base64 encryption scheme, to verify these files' compliance with the electronic invoicing security specifications set by the Zakat, Tax, and Customs Authority.

Do taxpayers need to continue following the first phase requirements until the second phase applies to them?

Yes, taxpayers must continue to follow the first phase requirements until the enforcement date according to the targeted categories announced by the authority. At this point, they will be notified to start following the second phase requirements.

What are the most important things to avoid when implementing electronic invoicing in the first and second phases?

In the first phase (Issuance and Preservation), avoid manually issuing invoices, issuing invoices that do not include the authority's requirements, using an electronic invoicing system that does not comply with the electronic invoicing requirements, and deleting electronic invoices after issuance. In the second phase (Integration and Linking), avoid issuing electronic invoices through an electronic invoicing system that has not been configured and linked with the authority.

What are some examples of prohibited specifications and functional characteristics for electronic invoicing systems in the second phase?

Examples include extracting or transferring the private key of the cryptographic stamp and changing the time or date in the electronic invoicing system.

What do I need to do to comply with the electronic invoicing requirements in the second phase?

This includes ensuring that the technical solution can connect to the internet, linking the technical solution with the Fatoora platform, ensuring the presence of additional fields in the electronic invoice for the second phase, and issuing and preserving invoices in the approved format, which is XML or PDF-A3 (including XML format).

Where can taxpayers and solution providers find all the requirements for the second phase?

Taxpayers and solution providers can view the connection requirements on the authority's electronic invoicing page by going to the authority's Fatoora platform and clicking the "System Developers" section.

Is it possible to access the Fatoora platform and the electronic invoicing systems developers' portal from anywhere outside Saudi Arabia, or is it restricted to within the country?

Access to both the Fatoora platform and the electronic invoicing systems developers' portal is available from anywhere in the world, not limited to Saudi Arabia.

What should users and technical solution developers consider when using the Software Development Kit (SDK)?

Three key considerations when using the SDK include ensuring invoices comply with the electronic invoicing regulation requirements through validation processes provided by the SDK, meeting all integration and linking phase requirements as outlined in the electronic invoicing regulation, and ensuring that electronic invoices or creditor and debtor notifications meet the electronic invoicing requirements.

Read our article comparing different accounting software to find out the best accounting software in Saudi Arabia that suits your business.

Ready to streamline your invoicing process and ensure full compliance with Saudi Arabia's electronic invoicing requirements? Wafeq is here to guide you through every step of the transition. Embrace the future of accounting today and join the community of businesses excelling with Wafeq's comprehensive solutions.

Ready to streamline your invoicing process and ensure full compliance with Saudi Arabia's electronic invoicing requirements? Wafeq is here to guide you through every step of the transition. Embrace the future of accounting today and join the community of businesses excelling with Wafeq's comprehensive solutions.

.png?alt=media)