Why Does the Invoice Title Sometimes Say "Simplified Tax Invoice" Instead of "Tax Invoice"?

When generating invoices, you may notice that the title sometimes reads Simplified Tax Invoice instead of Tax Invoice. This difference is not random; it depends on several factors, including whether your organization has a Tax Registration Number (TRN), where your organization is located (UAE or KSA), and whether your customer is a business or an individual.

Let’s explore these factors to understand how the correct invoice title is determined.

When Your Organization Doesn’t Have a TRN

If your organization does not have a TRN, the title of the invoice is straightforward. The title will simply be "Invoice" whether you are in the UAE or KSA.

When Your Organization Has a TRN

For UAE-Based Organizations

When your organization is based in the UAE and has a TRN, the invoice title will be determined based on whether your customer is a business (B2B) or an individual (B2C). For B2B customers with a valid TRN, the title will be "Tax Invoice." For B2C customers without a TRN, it will be "Simplified Tax Invoice."

For KSA-Based Organizations

If your organization is based in KSA, the process is similar but includes additional factors related to ZATCA (Zakat, Tax, and Customs Authority). The rules differ depending on whether your business is connected to ZATCA’s e-invoicing system (Phase 2).

Going forward, this article assumes your organization is based in Saudi Arabia.

Your organization is Not Connected to ZATCA

How it affects the Invoices module

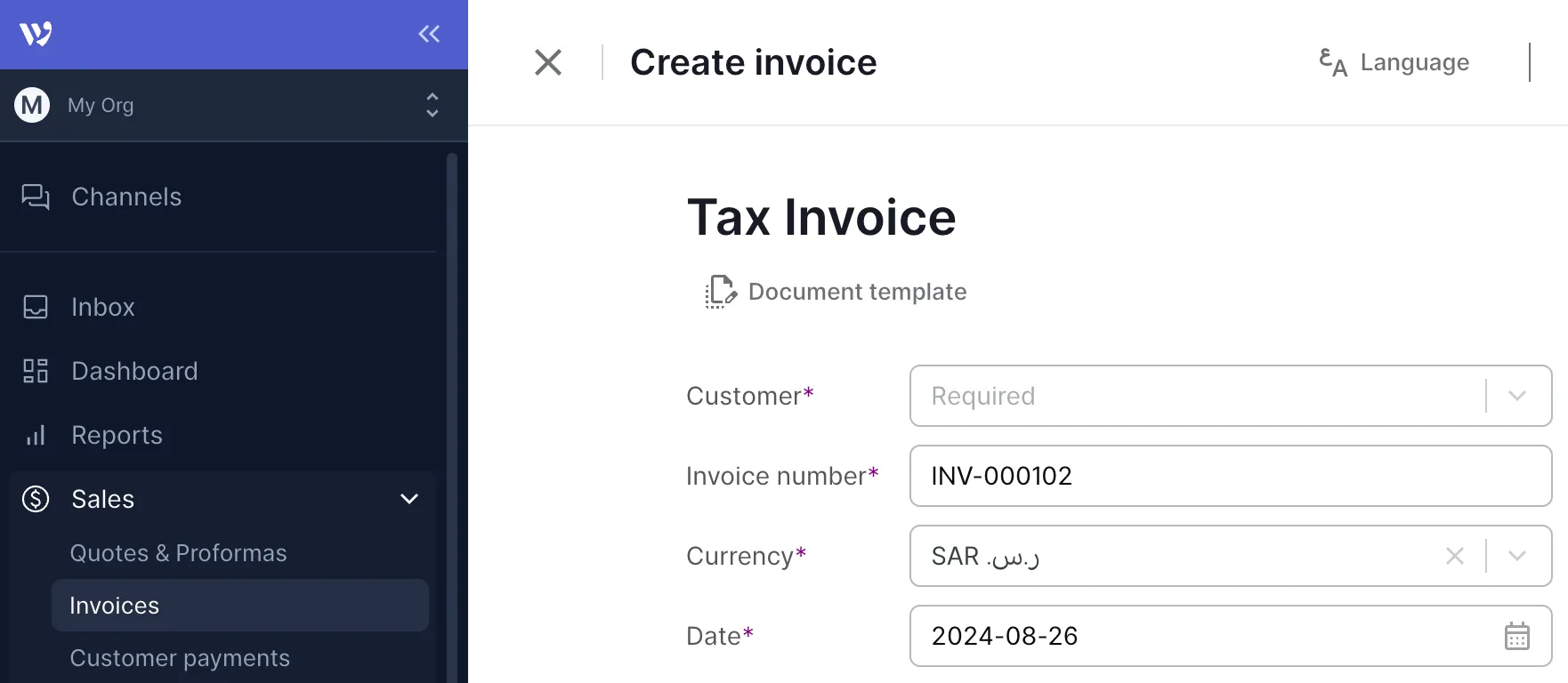

If your organization is Not Connected to ZATCA, ie not onboarded on Phase 2, the title shown in the create/edit form of the invoice (when no customer is selected) will default to "Tax Invoice."

Default title when no customer is selected

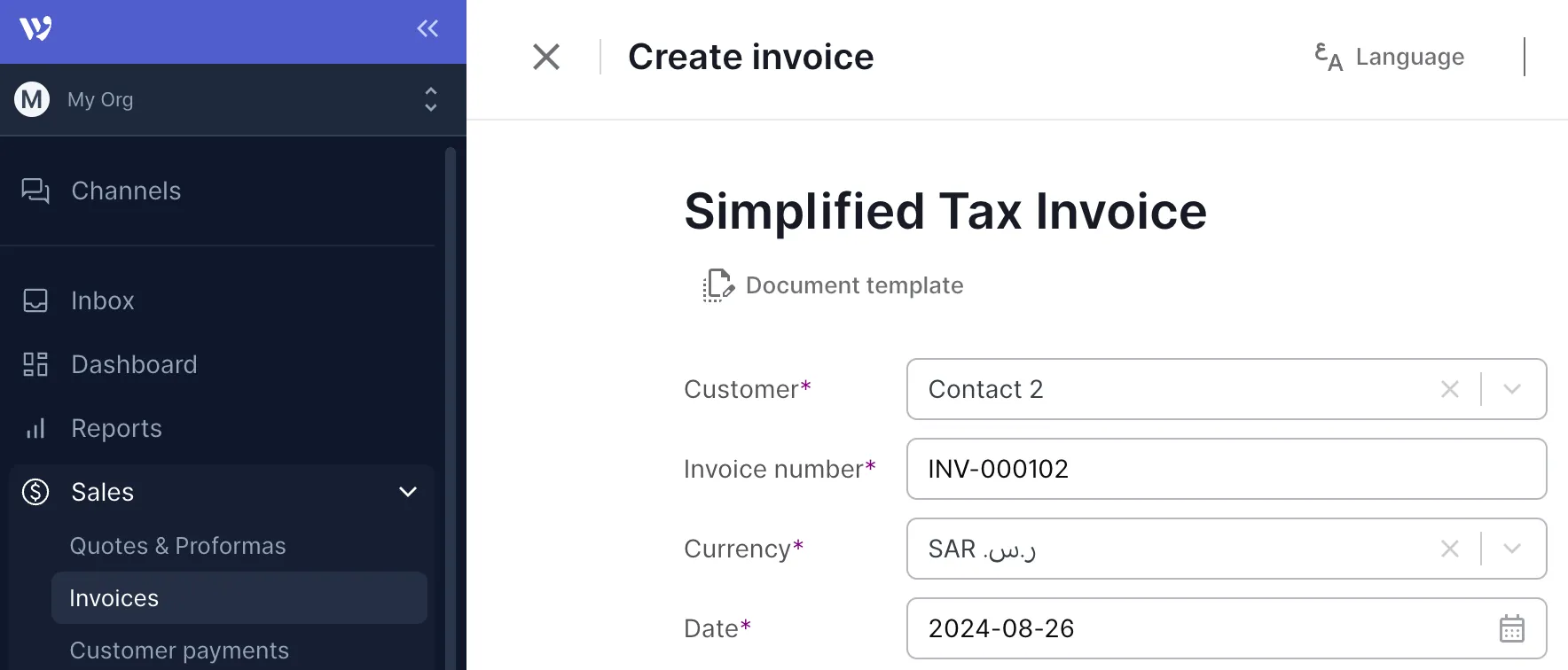

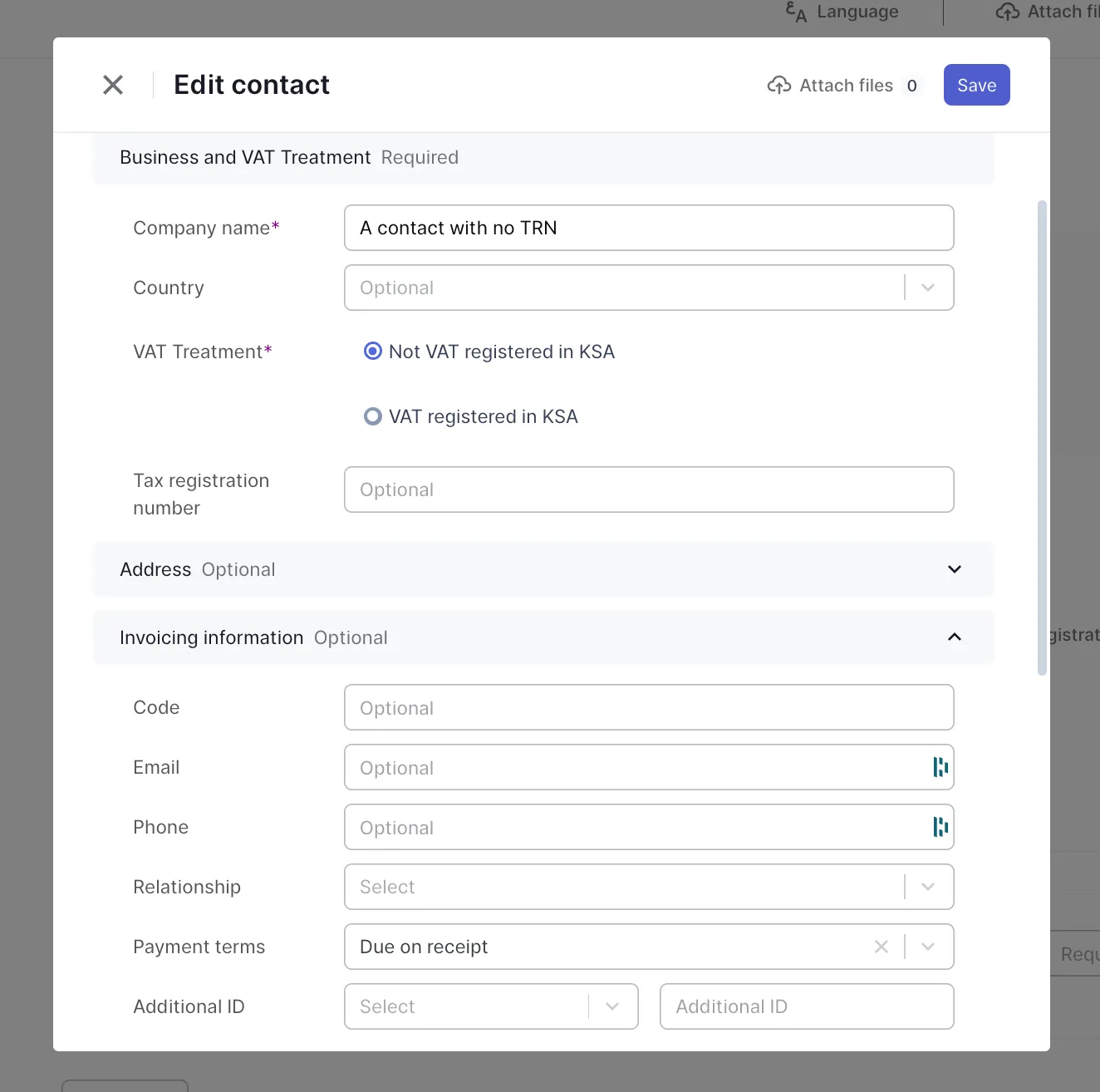

Once a customer is selected, the title changes based on the customer type. If the customer is a business (B2B) with a valid TRN or another acceptable form of identification (such as an additional ID), the invoice title will be "Tax Invoice." If the customer does not meet these criteria, the title will be "Simplified Tax Invoice." (as you can see in the below example)

A B2C contact because it has no TRN and no additional ID

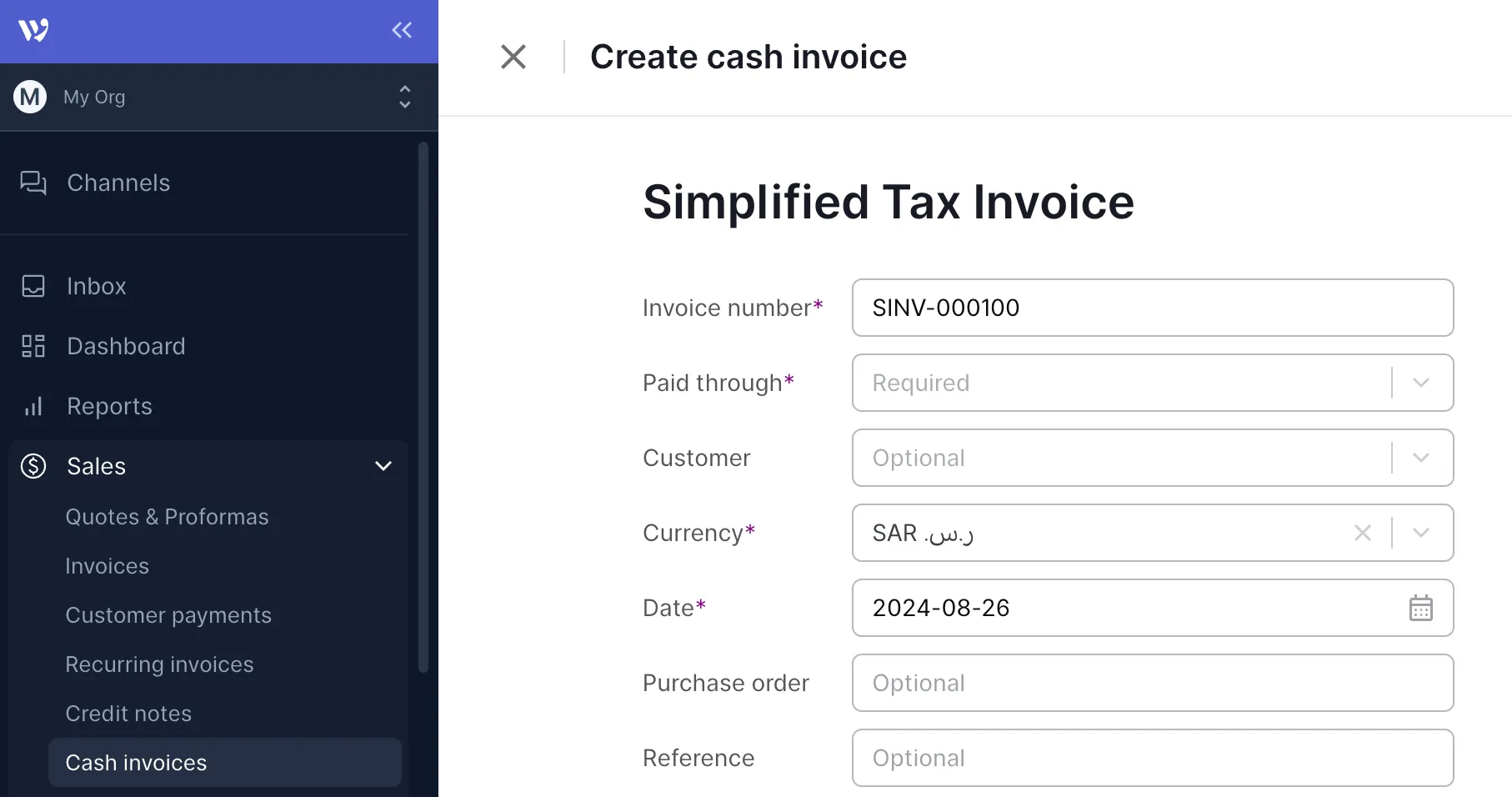

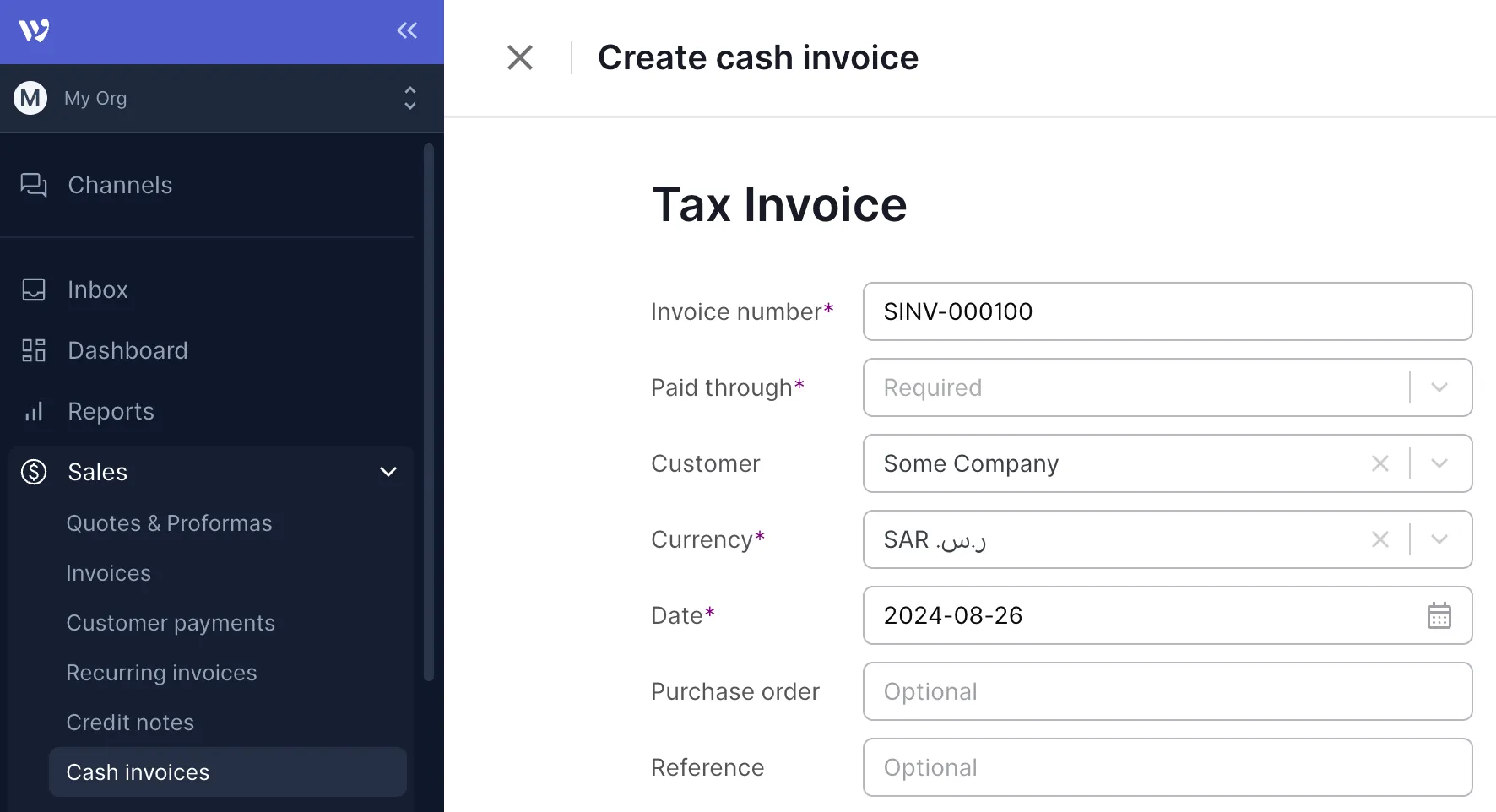

How it affects the Cash Invoices module

Similarly, for cash invoices, the title shown in the create/edit form (when no customer is selected) will also default to "Simplified Tax Invoice."

Default Title when no customer is selected

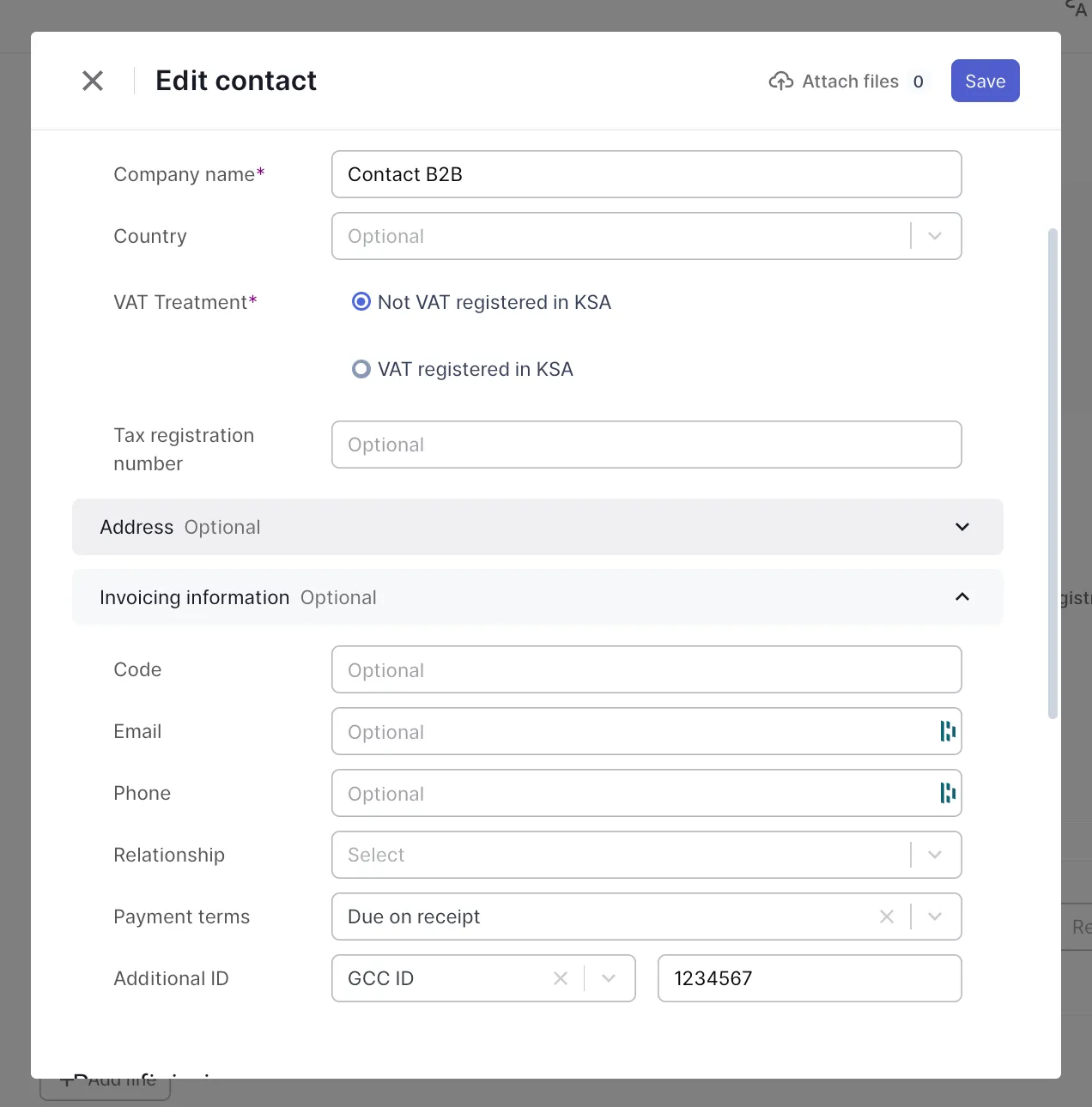

If a B2B customer with valid identification is selected, the title will change to "Tax Invoice." Otherwise, it stays as a "Simplified Tax Invoice."

This contact doesn't have a TRN but has a GCC ID in additional ID, so it gets treated as a B2B contact, ie as a Tax Invoice

Your organization is Connected to ZATCA

How does it affect the Invoices module

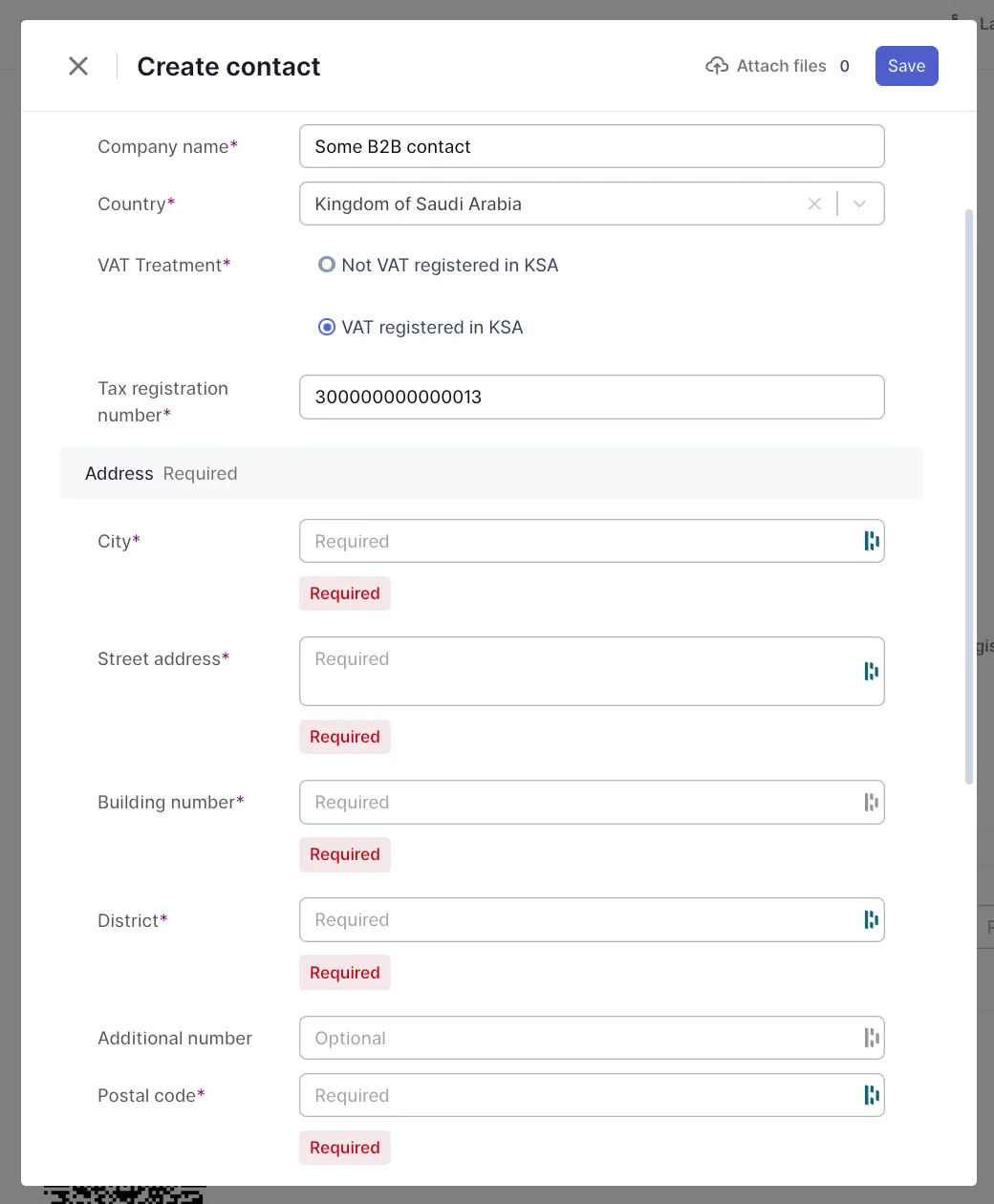

When connected to ZATCA, the title shown in the create/edit form of the invoice (when no customer is selected) will default to "Tax Invoice." Once a customer is selected, the title adapts based on the customer type. For B2B customers with valid TRN or additional ID and a valid address, the title remains "Tax Invoice." If these conditions are unmet, it changes to "Simplified Tax Invoice."

The one thing to remember about Phase 2 is that besides the previous rules mentioned above, the contact needs to have his address fields filled to have the invoice considered a Tax Invoice.

In Phase 2 e-invoicing, address fields are required for Tax Invoices

How it affects Cash Invoices module

The title shown in the create/edit form of the cash invoice (when no customer is selected) will default to "Simplified Tax Invoice."

If a B2B customer with valid identification (ie like above with TRN or some additional ID) and address is selected, the title changes to "Tax Invoice." Otherwise, it remains "Simplified Tax Invoice."

Summary

The final title of an invoice - whether "Tax Invoice" or "Simplified Tax Invoice" - depends primarily on the customer type, which is determined by the presence of a TRN or, in some cases, an additional form of ID. The customer is classified as B2B if they have a valid TRN or an acceptable additional ID. When connected to a tax authority like ZATCA, additional validation, such as having a complete address, may also be required for a customer to be treated as B2B.

The key difference between regular invoices and cash invoices lies in the default title that appears in the create/edit form when no customer is selected. For regular invoices, the default title will be "Tax Invoice" while for cash invoices, the default title is "Simplified Tax Invoice." However, once a customer is selected, both types of invoices follow the same rules for determining the final title (ie based on how we consider the customer to be B2B or B2C)

By understanding these rules, you can ensure that your invoices are correctly titled and compliant with relevant regulations. If you have any questions or need further clarification, our support team is here to help.

.png?alt=media)