Understanding Company Liquidation: Types, Processes, and Legal Implications

(1).png?alt=media)

The company liquidation is the process of closing a business and distributing its assets to satisfy outstanding debts. Whether due to insolvency, financial difficulties, or strategic business decisions, liquidation marks the formal end of a company's operations. However, this process is not always straightforward; it involves legal obligations, stakeholder considerations, and various financial outcomes that must be managed effectively.

In this article, we will delve into the different types of liquidation, the key steps involved in each, and the consequences for business owners, creditors, and employees. We'll also discuss the potential alternatives to liquidation and how businesses can explore solutions that may allow them to avoid closure.

Wafeq helps you maintain accurate financial records and stay compliant with local regulations in the UAE and KSA during liquidation. Let Wafeq streamline your tax and creditor management.

Wafeq helps you maintain accurate financial records and stay compliant with local regulations in the UAE and KSA during liquidation. Let Wafeq streamline your tax and creditor management.

Types of Company Liquidation

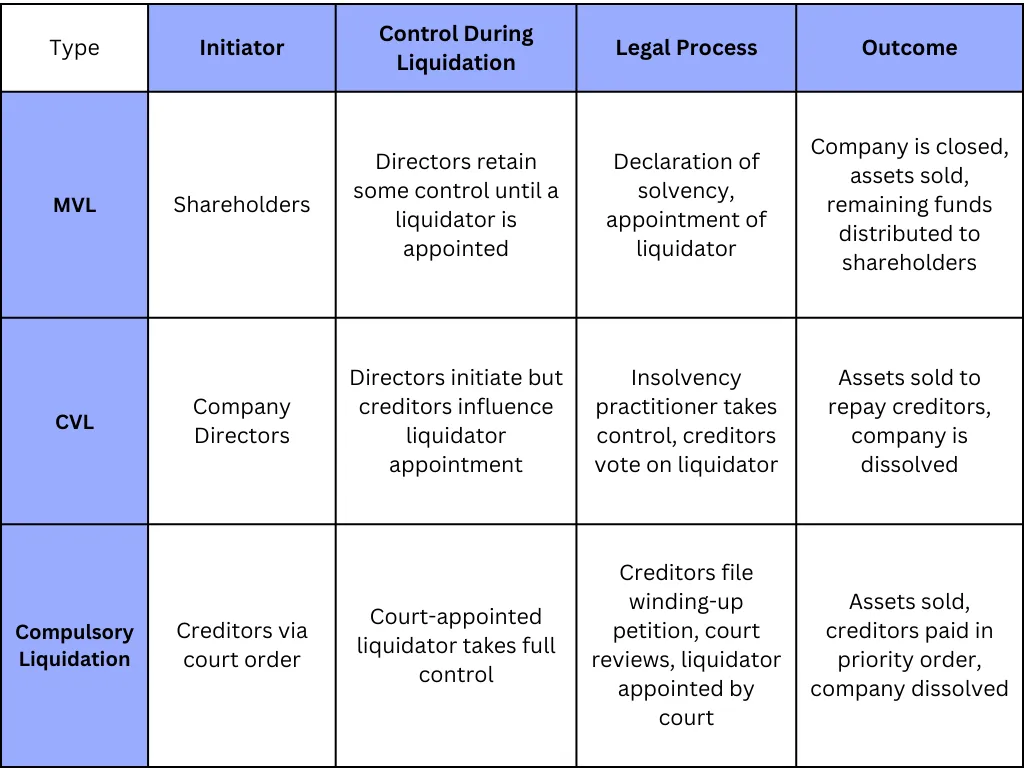

When a business decides to cease operations, it can go through one of several types of liquidation processes. These can broadly be divided into voluntary liquidation and compulsory liquidation. Each type serves a specific purpose, depending on the company's financial health and the circumstances leading to its closure.

Voluntary Liquidation

Voluntary liquidation occurs when the company’s directors or shareholders decide to close the business, rather than being forced to by a court or creditors. There are two main types of voluntary liquidation:

Members' Voluntary Liquidation (MVL)

Definition and Process:

Members' Voluntary Liquidation is a type of liquidation used by solvent companies, meaning the business can pay off its debts in full. It is initiated by the company's shareholders when they decide that the company should no longer continue operating.

The process starts with the directors signing a declaration of solvency, confirming that the company can repay its debts within a specified period (typically 12 months).

A licensed insolvency practitioner is then appointed to handle the process, which involves liquidating the company's assets, settling its liabilities, and distributing any remaining funds to shareholders.

When Applicable:

This type of liquidation is typically used when a company has completed its purpose or the owners want to retire or pursue other ventures without selling the company.

9 Fundamental Accounting Principles for Small Businesses.

Creditors' Voluntary Liquidation (CVL)

Definition and Process:

In contrast to MVL, Creditors' Voluntary Liquidation is initiated when a company is insolvent, meaning it can no longer meet its financial obligations or repay its debts.

The directors recognize the company's financial difficulties and opt for CVL to wind up the business in a structured manner. An insolvency practitioner is appointed to oversee the liquidation.

Creditors are informed of the company's insolvency and allowed to vote on the appointment of a liquidator. Once appointed, the liquidator takes control of the company’s assets, sells them to repay creditors, and dissolves the company.

When Applicable:

This process is commonly used when a company is facing significant financial struggles and cannot recover. It allows the directors to take proactive steps to liquidate the company rather than waiting for creditors to force the process.

Compulsory Liquidation

Definition and Key Triggers:

Compulsory Liquidation occurs when a company is forced into liquidation by a court order, usually at the request of creditors. This typically happens when the company has failed to pay its debts, and creditors believe that liquidation is the best way to recover their money.

The liquidation process begins with a winding-up petition filed by creditors, which a court then reviews. If the court agrees that the company is unable to pay its debts, it will issue a winding-up order.

Legal Process and Steps Involved:

Once the winding-up order is issued, the company is placed into liquidation, and a court-appointed liquidator takes control of the company's affairs. The liquidator's role is to sell off the company’s assets, distribute the proceeds to creditors based on their priority, and eventually dissolve the company.

Directors lose control of the business during this process, and the company's operations cease.

Reasons for Company Liquidation

Several factors may lead a company to go through the liquidation process, ranging from financial struggles to strategic business decisions. Below are the key reasons why businesses may opt for liquidation.

1. Insolvency

One of the most common reasons for company liquidation is insolvency—when a company can no longer pay its debts as they come due. This could be due to poor cash flow management, rising debts, or an unexpected downturn in revenue. In such cases, liquidation becomes necessary to settle the company’s debts by selling off its assets to repay creditors. Insolvency often triggers Creditors' Voluntary Liquidation (CVL) or Compulsory Liquidation.

2. Business Failures

Business failure occurs when the company’s operations are no longer sustainable due to various factors, including:

Poor management: Inadequate leadership and financial oversight can lead to declining performance.

Declining market demand: A product or service that is no longer in demand can result in lower sales and revenue, making it difficult for the company to continue operating.

Economic downturn: Broader economic issues, such as recessions, can impact even well-managed companies, reducing their ability to remain profitable.

When business failure occurs, liquidation may be seen as the only viable option to close the company and minimize further losses.

3. Voluntary Exit

Sometimes, a company may go into voluntary liquidation not because it is struggling financially, but because the owners wish to exit the business. Common reasons for voluntary exit include:

Retirement: Business owners who wish to retire may decide to liquidate the company if there is no clear successor.

Pursuing other opportunities: Owners may opt for liquidation if they want to move on to new ventures or investments and no longer wish to operate the existing company.

In such cases, Members' Voluntary Liquidation (MVL) is often used if the company is solvent.

4. Court Orders or Legal Issues

Companies may be forced into compulsory liquidation due to legal actions initiated by creditors. When a company fails to pay its debts, creditors can take legal action to recover their money. This usually begins with filing a winding-up petition in court, and if successful, the court will issue a winding-up order to liquidate the company’s assets. Other legal issues, such as tax disputes or breaches of regulations, can also lead to forced liquidation if the company is unable to resolve the matter.

Read more: How to choose the right accounting software for UAE businesses.

The Liquidation Process

The liquidation process involves several critical steps and considerations that ensure the company’s closure is handled in an orderly and legal manner. Below is a breakdown of the key stages in the liquidation process:

Pre-liquidation Considerations

Before initiating liquidation, there are several important steps to take:

- Initial Assessment of the Company’s Financial Status: The directors and shareholders need to assess whether the company is solvent or insolvent. This determination affects which type of liquidation process will be followed—Members' Voluntary Liquidation (MVL) for solvent companies or Creditors' Voluntary Liquidation (CVL) for insolvent ones.

- Communication with Stakeholders: It's crucial to keep stakeholders such as employees, creditors, and shareholders informed about the potential liquidation. This transparency can help manage expectations and avoid legal disputes.

- Hiring a Licensed Insolvency Practitioner: The appointment of a licensed insolvency practitioner (IP) is a legal requirement in both voluntary and compulsory liquidation. The IP will oversee the liquidation process, including asset sales, debt settlements, and distributions to creditors and shareholders.

Read also: Book Value: Definition, Formula, Calculation Simply Explained With Examples.

Steps in Liquidation

The liquidation process itself involves several legal and administrative actions, depending on whether the company is solvent or insolvent:

Declaration of Insolvency or Solvency:

- For solvent companies, the directors must sign a declaration of solvency, confirming that the company can repay all its debts within a certain period.

- For insolvent companies, no such declaration is made, and the company proceeds directly to voluntary liquidation (CVL) or compulsory liquidation.

Appointment of a Liquidator: A liquidator (the insolvency practitioner) is appointed by either the shareholders (in voluntary liquidation) or the court (in compulsory liquidation). The liquidator takes over the management of the company.

Liquidator’s Role: The liquidator is responsible for:

- Selling the company’s assets.

- Settling outstanding debts with the company's creditors in a prioritized manner.

- Distributing any remaining funds to shareholders (if applicable).

- Reporting on the liquidation process to stakeholders.

Timeline of the Process: The liquidation timeline can vary depending on the company’s size, the complexity of its operations, and the number of creditors involved. Smaller companies may complete liquidation within a few months, while larger or more complex cases could take years.

Read also: Financial Accounting: A Comprehensive Overview.

Impact on Directors and Employees

Directors’ Obligations and Restrictions During Liquidation: Once the liquidation process begins, the directors' control over the company ceases, and they are obligated to cooperate fully with the liquidator. Directors may be restricted from engaging in wrongful trading (continuing to operate the business despite knowing it's insolvent) and could face personal liability for company debts if found to have acted improperly before liquidation.

Rights and Claims of Employees: Employees often have rights to redundancy payments, unpaid wages, and other outstanding benefits such as pensions. These claims are typically treated as priority debts, meaning they are addressed early in the liquidation process before payments are made to unsecured creditors. Employees can file claims with the liquidator for any outstanding payments due to them.

Consequences of Liquidation

The consequences of liquidation extend to various stakeholders involved in the business, including the company itself, its creditors, employees, and shareholders. Below is an overview of the key outcomes for each group:

For the Company

Dissolution of the Company After Liquidation: Once the liquidation process is complete, the company is officially dissolved. This means the company’s legal existence comes to an end, and it is removed from the official company registry. The business is no longer allowed to operate, trade, or enter into new contracts.

Permanent Closure of Operations: Liquidation results in the permanent cessation of all business activities. The company’s assets are sold off, contracts are terminated, and any remaining employees are laid off. The company's brand, intellectual property, and other non-physical assets may also be liquidated.

For Creditors

Prioritization of Debts: Secured vs. Unsecured Creditors: In liquidation, creditors are paid according to a priority system. Secured creditors (those with collateral, such as a mortgage on company property) are paid first. After secured creditors, preferential creditors (such as employees owed unpaid wages) are paid. Finally, unsecured creditors (those without any collateral) receive what remains from the sale of assets, often at a much lower percentage than what is owed.

Distribution of Remaining Assets: Once the liquidator has collected and sold the company’s assets, they distribute the proceeds to creditors according to the legal hierarchy. Any remaining funds, after all debts are paid, may be distributed to shareholders, although in many cases, there is little left for equity holders in an insolvent liquidation.

For Stakeholders (Employees, Shareholders, etc.)

Effect on Employees: Employees are among the most affected stakeholders in the event of liquidation. The company’s closure typically results in job losses. Employees may be entitled to redundancy payments and other outstanding wages or benefits. These claims are treated as priority debts, meaning they are paid before other unsecured creditors. However, if the company's assets are insufficient, government compensation schemes may provide some level of support for unpaid wages and benefits.

Effect on Shareholders: Shareholders are often the last to receive any proceeds from liquidation, and in the case of insolvency, they may lose their entire investment in the company. Once creditors have been paid, if there are any remaining funds, they are distributed to shareholders according to the type of shares they hold. In most cases of insolvency, shareholders receive nothing, as the company’s debts exceed its assets.

As you consider liquidation, having accurate records of your assets and liabilities is crucial. With Wafeq, you can easily manage your financial data and ensure a smoother liquidation process. Get started now with Wafeq

As you consider liquidation, having accurate records of your assets and liabilities is crucial. With Wafeq, you can easily manage your financial data and ensure a smoother liquidation process. Get started now with Wafeq

Alternatives to Liquidation

Liquidation is not always the only option for struggling companies. Businesses facing financial difficulties may explore several alternatives that could allow them to continue operating or restructure their finances. Here are some common alternatives to liquidation:

1. Restructuring or Refinancing

Restructuring involves reorganizing the company’s debts, assets, and operations to improve financial performance. This could include negotiating new payment terms with creditors, cutting operational costs, or selling off non-core assets.

Refinancing focuses on replacing old debt with new, more manageable debt. By renegotiating terms, extending repayment periods, or securing lower interest rates, a company can ease its immediate financial pressures and avoid liquidation.

Key Benefits:

- Allows the company to continue operating while addressing its financial issues.

- Can prevent job losses and preserve the company's reputation in the market.

- Provides time for management to implement turnaround strategies.

2. Company Voluntary Arrangements (CVA)

A Company Voluntary Arrangement (CVA) is a formal agreement between an insolvent company and its creditors. It allows the company to repay its debts over an agreed period, typically with reduced monthly payments, while continuing to trade.

The process requires approval from at least 75% of creditors by value, after which the CVA becomes legally binding on all creditors.

A CVA is overseen by an insolvency practitioner who ensures that the terms of the agreement are adhered to.

When Applicable:

A CVA is suitable for companies facing temporary financial difficulties but that have a viable business model. It gives the company breathing room to stabilize its operations and potentially recover without being forced into liquidation.

3. Administration

Administration is a formal process in which a company is placed under the control of an appointed administrator (often an insolvency practitioner) to prevent liquidation and give the business time to restructure or find a buyer.

The administrator's primary goal is to rescue the company as a going concern. If that is not possible, they aim to achieve a better outcome for creditors than liquidation would provide.

During administration, the company is protected from legal actions by creditors, allowing it to continue trading while the administrator assesses the best way forward.

Benefits of Administration:

- Provides immediate protection from creditor action, preventing the company from being forced into compulsory liquidation.

- Allows the company to continue trading and potentially find new investments or buyers.

- Often used as a bridge to further restructuring or a sale of the business.

Legal and Tax Implications of Liquidation

The legal and tax implications of liquidation vary depending on local laws. Here's how they apply in the UAE, KSA, and Egypt:

Legal Requirements

United Arab Emirates (UAE)

Legal Framework: Liquidation in the UAE is governed by the UAE Commercial Companies Law (Federal Law No. 2 of 2015). Companies must appoint a liquidator, who manages the liquidation process, including asset sales and debt settlements.

Process: The liquidation process begins with a board resolution and notifying relevant authorities, including the Department of Economic Development (DED) and the Ministry of Economy. Companies must submit all licenses and cancel their registrations to formally dissolve.

Court-ordered Liquidation: Compulsory liquidation can occur if a creditor files a petition with the court, typically due to unpaid debts. The court may appoint a liquidator to oversee the process.

Accounting Cloud Software in UAE: Revolutionize Your Business with Wafeq.

Saudi Arabia (KSA)

Legal Framework: In Saudi Arabia, liquidation follows the Saudi Companies Law. The Ministry of Commerce oversees the process, which includes appointing a liquidator and notifying all shareholders and creditors.

Process: Liquidation can be voluntary, but creditors can also petition for court-ordered liquidation if the company defaults on payments. Directors must cease company activities except those related to the liquidation.

Regulatory Bodies: The process includes reporting to authorities like the Ministry of Commerce and Investment (MCI), and General Authority of Zakat and Tax (ZATCA) for tax compliance.

The best accounting software in Saudi Arabia.

Egypt

Legal Framework: Egyptian liquidation is governed by the Egyptian Companies Law. A liquidator must be appointed to settle the company’s obligations.

Court-ordered Liquidation: This occurs when creditors file for insolvency due to unpaid debts. The General Authority for Investment and Free Zones (GAFI) oversees the liquidation process.

Process: Companies must submit to GAFI, the Tax Authority, and cancel commercial registrations. Public notices are also required to alert stakeholders.

Tax Obligations

UAE

Corporate Tax: The UAE does not currently impose corporate income tax on most businesses (outside of certain sectors). However, the upcoming Corporate Tax Law set to be introduced in 2024 may have implications for tax liabilities during liquidation.

VAT: Companies in the UAE are required to deregister from VAT with the Federal Tax Authority (FTA) during liquidation. Any outstanding VAT must be paid, and VAT records must be submitted to the FTA.

KSA

Zakat and Tax: Companies are required to settle their Zakat obligations with the General Authority of Zakat and Tax (GAZT) before liquidation. Zakat is calculated on the company's assets, and the final Zakat assessment must be completed before closing the business.

VAT: If the company is registered for VAT, all VAT returns must be filed, and any unpaid VAT must be cleared before liquidation.

Egypt

Corporate Tax: Companies undergoing liquidation must file a final corporate tax return with the Egyptian Tax Authority. Any outstanding tax liabilities, including corporate income tax and sales tax, must be settled.

VAT: Similar to KSA and UAE, businesses in Egypt must submit all pending VAT returns and clear any outstanding VAT debts during liquidation.

Capital Gains Tax and Potential Tax Reliefs

In Egypt, capital gains tax may apply to shareholders if there is a gain from the sale of company assets during liquidation.

Tax reliefs: In both the UAE and KSA, shareholders may not face capital gains tax on distributions, as these jurisdictions have favorable tax regimes. However, corporate tax (if applicable) or Zakat obligations must be met.

Read in detail: VAT Rates by Country: A Comprehensive Guide.

Real-life Case Studies of Company Liquidation

Examining real-life case studies of company liquidation can provide valuable insights into how liquidation decisions, whether timely or delayed, affect businesses and their stakeholders. Here, we’ll look at examples of both successful liquidations and those that faced negative consequences due to delayed action.

Successful Liquidations

1. Toys "R" Us (UAE, KSA)

Overview: In 2018, Toys "R" Us faced liquidation globally due to declining sales, heavy debt burdens, and increased competition from e-commerce. However, in markets like the UAE and KSA, liquidation was executed smoothly, with creditors repaid from the proceeds of store closures and asset sales.

Benefit: Early decision-making allowed the company to recover some value from the liquidation process, preserving relationships with suppliers and creditors in the region. This also helped avoid further financial damage and allowed the owners to plan new ventures in the same market under different brand strategies.

2. Carillion (UK)

Overview: Carillion, a major construction and facilities management company, entered liquidation in 2018 after being unable to secure refinancing. While the process was lengthy, the company’s early action in the UK allowed certain operations in the UAE and KSA to be transferred to other companies before liquidation hit those markets.

Benefit: By acting early in these regional markets, Carillion was able to preserve jobs in KSA and UAE, minimize the impact on ongoing projects, and shield local operations from more severe financial repercussions seen in the UK.

Consequences of Delayed Liquidation

1. Saudi Oger (KSA)

Overview: Saudi Oger, one of the largest construction companies in Saudi Arabia, collapsed in 2017 after years of financial difficulties, delayed payments, and mounting debt. The company's delayed action in addressing insolvency led to severe consequences, including job losses for thousands of employees and millions in unpaid wages.

Consequences: The delayed decision to enter liquidation worsened the financial situation for creditors, employees, and contractors. Had liquidation been initiated earlier, the company could have potentially settled debts in a more orderly fashion and mitigated the impact on stakeholders.

2. Abraaj Group (UAE)

Overview: The Dubai-based private equity firm Abraaj Group faced liquidation in 2018 after a major scandal involving mismanagement of funds and inability to meet debt obligations. The delayed response from management, who initially denied any financial issues, led to the collapse of what was once the largest private equity firm in the Middle East.

Consequences: The delayed liquidation process caused severe damage to Abraaj’s global reputation and investor confidence. Had the company acted earlier and initiated a controlled liquidation, it could have avoided the scandal and preserved more value for creditors and stakeholders.

Read also: Mastering the Art of Budgeting: A Comprehensive Guide for Businesses.

Company liquidation is a complex but essential process for businesses that are either struggling to meet their financial obligations or deciding to cease operations voluntarily. Understanding the different types of liquidation, the legal and tax implications, and the steps involved can help businesses make informed decisions when faced with financial challenges. Timely liquidation decisions can often lead to more favorable outcomes for creditors, employees, and shareholders, while delayed actions tend to exacerbate financial difficulties. Business owners need to seek professional advice, whether they are considering liquidation or exploring alternative options such as restructuring or administration.

Ultimately, liquidation marks the end of a company’s journey, but with the right approach, it can be a structured and fair process that mitigates losses for all stakeholders involved.

Facing financial challenges? Use Wafeq to monitor your financial reports and determine whether restructuring or liquidation is the right path for your business. Start tracking your financial health today with Wafeq!

Facing financial challenges? Use Wafeq to monitor your financial reports and determine whether restructuring or liquidation is the right path for your business. Start tracking your financial health today with Wafeq!

.png?alt=media)