Proforma Invoice: Everything You Need to Know and How Wafeq Simplifies the Process

.png?alt=media)

A proforma invoice is a preliminary bill of sale sent to buyers in advance of the shipment or delivery of goods or services. It serves as a quotation, outlining the key terms of the sale such as products, quantities, and pricing, but it is not legally binding. The main purpose of a proforma invoice is to provide an estimate of the transaction details, giving the buyer a clear understanding of the goods or services they will receive and the expected costs.

Primary Purpose of a Proforma Invoice:

Estimation Document: A proforma invoice functions as a quotation, allowing buyers and sellers to agree on the terms before a commercial invoice is generated. It typically includes the itemized list of products or services, unit prices, applicable taxes (e.g., VAT), shipping costs, and payment terms.

No Legal Obligation: Unlike a final invoice, a proforma invoice does not demand immediate payment. It’s used mainly for communication and clarification, ensuring both parties are on the same page before the transaction proceeds.

Customs and Importing: Proforma invoices are commonly used for international trade, as they help with the clearance of goods at customs by providing an estimate of duties and taxes without being a binding document.

Say goodbye to manual invoicing and tax errors! With Wafeq, creating and managing proforma invoices is simple and VAT-compliant. Start using Wafeq today and transform how you handle your invoicing.

Say goodbye to manual invoicing and tax errors! With Wafeq, creating and managing proforma invoices is simple and VAT-compliant. Start using Wafeq today and transform how you handle your invoicing.

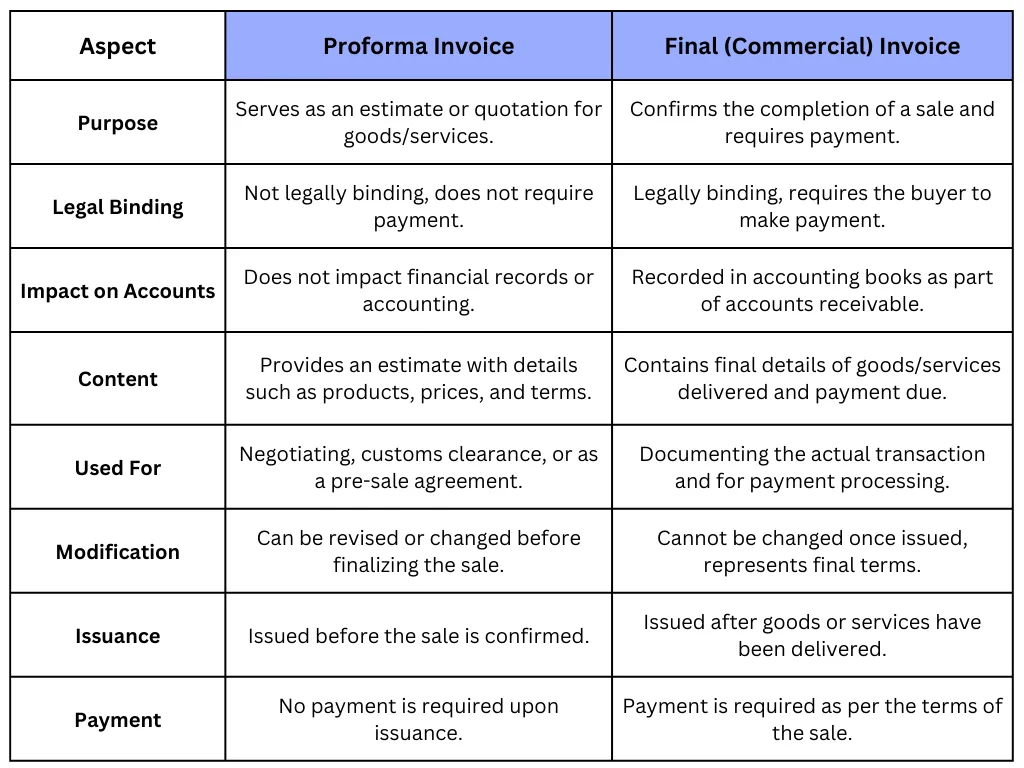

Difference Between Proforma and Final Invoices:

Here is the comparison between proforma invoices and final invoices:

Importance of Proforma Invoices

Proforma invoices are critical in business transactions, especially in international trade and negotiations. Here are the key reasons why they are important:

Providing an Estimate for the Buyer:

A proforma invoice serves as a formal quotation or estimate for the buyer. It outlines the terms of sale, including product details, quantities, prices, taxes, and delivery information. This document helps buyers understand the costs involved before making a final purchasing decision.

Clarity in Transaction Terms:

The proforma invoice ensures that both the buyer and seller are aligned on the terms of the transaction. It eliminates potential misunderstandings by clearly defining the terms, such as payment methods, delivery dates, and applicable taxes. This transparency is crucial, particularly in complex or large-scale transactions.

Customs and Import Documentation:

Proforma invoices are often used in international trade to facilitate customs clearance. Customs authorities use the proforma invoice to assess duties and taxes on imported goods. It is especially important for goods that require pre-approval for export or import, ensuring smooth clearance at the border.

Financial Planning for Buyers:

Buyers can use the proforma invoice to allocate funds, arrange financing, or secure foreign exchange for international purchases. It acts as a financial document that aids in budgeting and planning for future expenses.

Non-Binding Nature:

A key advantage of proforma invoices is that they are non-binding. This allows for flexibility, as the buyer can request changes or modifications without committing to payment. It also gives sellers the ability to revise prices or adjust terms before the final sale is confirmed.

Internal Approval Process:

In many organizations, the proforma invoice is used for internal approval processes. Departments may need to get approvals from management or finance teams before proceeding with the purchase. The proforma invoice serves as a reference for all the details of the intended transaction.

Supporting Sales Discussions:

In negotiations, a proforma invoice is an effective tool for communicating the potential sale terms. It can be used to finalize agreements, negotiate better prices, or offer discounts. For sellers, it provides a structured way to present their offering without issuing a final invoice.

Legal Documentation for Specific Purposes:

Although a proforma invoice is not legally binding, it can still serve as an official document in certain scenarios, such as trade finance applications, letters of credit, or to prove intent to export goods. In such cases, it holds importance in contractual obligations between buyers, sellers, and financial institutions.

Challenges of Manual Invoicing:

Manual invoicing poses several challenges that can hinder business efficiency, accuracy, and growth. Below are some of the most common issues faced:

1. Human Errors:

Manually entering invoice details increases the risk of mistakes such as incorrect figures, miscalculations, and misplaced information. These errors can result in payment disputes, delayed payments, and strained relationships with customers.

2. Time-Consuming:

Creating invoices manually takes significantly more time compared to automated invoicing systems. Each invoice must be generated from scratch, which can slow down the billing process, especially for businesses dealing with high volumes of transactions.

3. Inefficient Tracking:

Keeping track of unpaid invoices or follow-ups can be cumbersome with manual invoicing. There's a greater chance of missing deadlines for payments, leading to cash flow issues. Automated systems, on the other hand, offer timely reminders and status updates.

4. Limited Scalability:

For growing businesses, manual invoicing becomes increasingly unsustainable as the number of clients and transactions rises. Scaling up would require more time and resources, making it challenging to keep up with demand.

5. Lack of Integration with Other Systems:

Manual invoices often cannot integrate seamlessly with accounting software or other business systems. This lack of integration requires manual data entry into various systems, doubling the workload and increasing the risk of discrepancies between records.

6. Delays in Payment Processing:

Since manual invoicing relies on human input, there are often delays in issuing invoices and tracking payments. In turn, customers may take longer to pay, impacting the business’s cash flow.

7. Storage and Retrieval Issues:

Storing paper invoices or spreadsheets can lead to disorganization and difficulty in retrieving specific invoices when needed. Over time, this creates inefficiencies in audit processes or when tracking historical transactions.

8. Compliance Risks:

In countries with strict tax regulations like the UAE, manual invoicing can lead to compliance issues. Errors in VAT calculations or missing invoices could result in fines or penalties from tax authorities.

9. Higher Operational Costs:

Although manual invoicing may seem cost-effective in the short term, the long-term operational costs related to errors, inefficiencies, and the need for additional labor can outweigh any initial savings.

10. Customer Dissatisfaction:

Customers expect timely and accurate invoices. Delays, errors, or inconsistencies in invoicing can lead to frustration and a negative perception of the business, potentially affecting customer loyalty.

The impact of manual processes on business productivity and compliance in the UAE context.

Read also: How to Create Effective Sales Quotations That Win Business.

Step-by-Step: Creating a Proforma Invoice in Wafeq:

In Wafeq, a proforma invoice can be generated in a few simple steps. The platform allows you to send quotations to clients, and when necessary, you can easily convert these quotes into proforma invoices without creating any actual accounting entries or financial impacts until it's confirmed or converted into a final invoice.

Steps to Create a Proforma Invoice:

- Start by navigating to the "Quotes and Proformas" section from the side menu.

- Click on Add Quote. Wafeq will automatically assign a quote number.

- Details of the Quote/Proforma Invoice:

- Select the currency.

- Choose the contact (your client) or create a new one directly in the quote form.

- You can also assign it to a project if needed.

- Choose the place of supply (if relevant, especially for VAT).

- Add the line items, including the item description, quantity, price, and any applicable VAT or discount rates.

Optional Details: Include additional information like payment instructions, stamp, or signature.

Once the quote is complete, you can save or send it directly through Wafeq. You can always choose to convert the quote into a proforma invoice as needed.

2. Converting a Quote to a Proforma Invoice in Wafeq:

After creating a quote, converting it into a proforma invoice is simple:

- Open the created quote, click on Edit, and change the document type from the quote to a proforma invoice.

- The conversion is seamless, and all details remain the same. This allows businesses to present a detailed overview of their services/products before finalizing the transaction.

Steps to convert a quote to an invoice in Wafeq.

How Wafeq Simplifies Proforma Invoicing for UAE Businesses:

Wafeq simplifies the proforma invoice process for UAE businesses by providing an easy-to-use platform for seamless creation and management of invoices. It ensures VAT compliance by automatically incorporating the correct tax rates, making conversions to final invoices simple and accurate. Wafeq’s integration with other financial processes, such as inventory and payroll, ensures that all data is interconnected, enhancing business operations. With automated invoice conversions, tracking, and powerful reporting tools, businesses can manage their cash flow more effectively and make informed financial decisions.

Read more: Unlock Tax Efficiency: Best VAT Compliant Accounting Software in the UAE.

Advantages of Using Wafeq for Proforma Invoicing:

- Automation: Less manual entry means fewer errors and faster processes.

- Compliance: Automated VAT handling tailored to UAE businesses ensures full compliance with local tax laws.

- Integration: Fully integrated with other financial processes such as bank reconciliation and inventory management.

- User-friendly Interface: The intuitive interface allows users to quickly create, send, and convert proforma invoices.

In conclusion, proforma invoices serve as an essential tool for businesses in the UAE, offering a non-binding estimate of sales terms while ensuring transparency and smoother business transactions. With Wafeq, businesses can streamline the entire invoicing process—from creating proforma invoices to converting them into VAT-compliant final invoices. The platform’s seamless integration with other financial modules and automated features ensures that businesses save time, reduce errors, and stay compliant with UAE regulations. Wafeq not only simplifies invoicing but also empowers businesses with valuable insights for better financial decision-making.

Ready to simplify your invoicing process? Wafeq allows you to effortlessly create, manage, and convert proforma invoices while staying compliant with UAE tax regulations. Make your invoicing seamless with Wafeq.

Ready to simplify your invoicing process? Wafeq allows you to effortlessly create, manage, and convert proforma invoices while staying compliant with UAE tax regulations. Make your invoicing seamless with Wafeq.

.png?alt=media)