Profit & Loss vs. Balance Sheet: Quick Answers to Key Questions

The profit and loss account and the balance sheet are two of the most important financial reports companies and investors rely on. Despite their common origins, there are key differences between the two that must be noted when preparing or analyzing them—in this article, we’ll list them all.

Understanding your financial statements is crucial for business success. Simplify your accounting with Wafeq and gain clear insights into your profit, loss, and balance sheet. Sign up today and take control of your business finances!

Understanding your financial statements is crucial for business success. Simplify your accounting with Wafeq and gain clear insights into your profit, loss, and balance sheet. Sign up today and take control of your business finances!

Introduction To The Differences Between Profit And Loss And Balance Sheet

The position statement, in other words, the balance sheet, is a document that details the company's financial situation as of a particular date.

It lists all the company's assets, equity, and liabilities. On the contrary, a profit and loss account displays the income realized and costs incurred by the firm throughout operations in a fiscal year.

Financial statements are generally made up of these two and the cash flow statement. They both aid all stakeholders in determining the enterprise's financial status, profitability, and performance.

In this article, we go into more detail about the distinctions between the balance sheet and the profit and loss account, so keep reading.

Balance Sheet Simply Explained

A balance sheet functions like a mirror, giving the user a clear picture of the firm's true financial situation.

The situation will be represented in the firm's capital, liabilities, and asset status as of a specific date.

The balance sheet is sometimes referred to as a position statement for this precise reason.

We manage our books using a double-entry method, where each debit has a matching credit. Therefore, according to the accounting equation, the sum of the asset and liability sides must equal one another.

Owner's equity, or capital, and creditor equity are both found on the liabilities side. In other words, the claim of the owners and creditors must match the value of the company's assets.

The balance sheet has two sides:

The balance sheet has two sides:

Assets + Liabilities and Equity

Balance Sheet Characteristics

- It is an asset and liability statement.

- It includes the final balances or the closing balance of all the company's assets and liabilities.

- At a particular time, which coincides with the conclusion of the accounting period, we compile a balance sheet.

- Provides information about the company's actual financial situation.

Uses Cases Of The Balance Sheet

- After the fiscal year, it shows the entire amount of the company's assets and liabilities.

- Aids in determining the firm's operating capital and capital employed.

- The financial health of the business may be assessed using the information from the balance sheet.

- Gives stakeholders pertinent information to aid in the future decision-making process.

Read more about Understanding Company Assets On The Balance Sheet.

Profit And Loss Account Simply Explained

The enterprise's profit and loss account details the firm's net profit or loss. This account is produced for one business operation cycle. Since it is a nominal account, the transactions are recorded by the standards that apply to that account.

You should take note of the fact that we create profit and loss records for a single operating cycle, or 12 months, in this instance.

Firms can, however, also create quarterly profit and loss statements. All the costs and losses in this are displayed on the debit side, whilst all the revenues and profits are displayed on the credit side.

You might be wondering why we convert the trading account's gross profit and loss into the profit and loss account's debit and credit.

To comply with the nominal accounting rule, which states that all costs and losses should be debited and all revenue and profits should be credited, we do this.

There are four main categories in which the costs considered in determining net profit are divided:

- Expenses for administration

- Costs of Selling & Distribution

- Financial Outlays

- Legal Costs

Characteristics Of A Profit And Loss Account

- Normative Account

- Created at the end of the fiscal year

- The company should use the accrual approach while preparing the profit and loss account.

- All incomes—aside from those derived from the sale of goods—are taken into account.

- Net profit or loss is the result of the profit and loss statement. In the event of a proprietorship business, this sum is added to the capital account. However, it is included in the profit and loss appropriation account for the partnership operation.

Read also: Understanding Balance Sheets: A Simplified Guide for Non-Accountants.

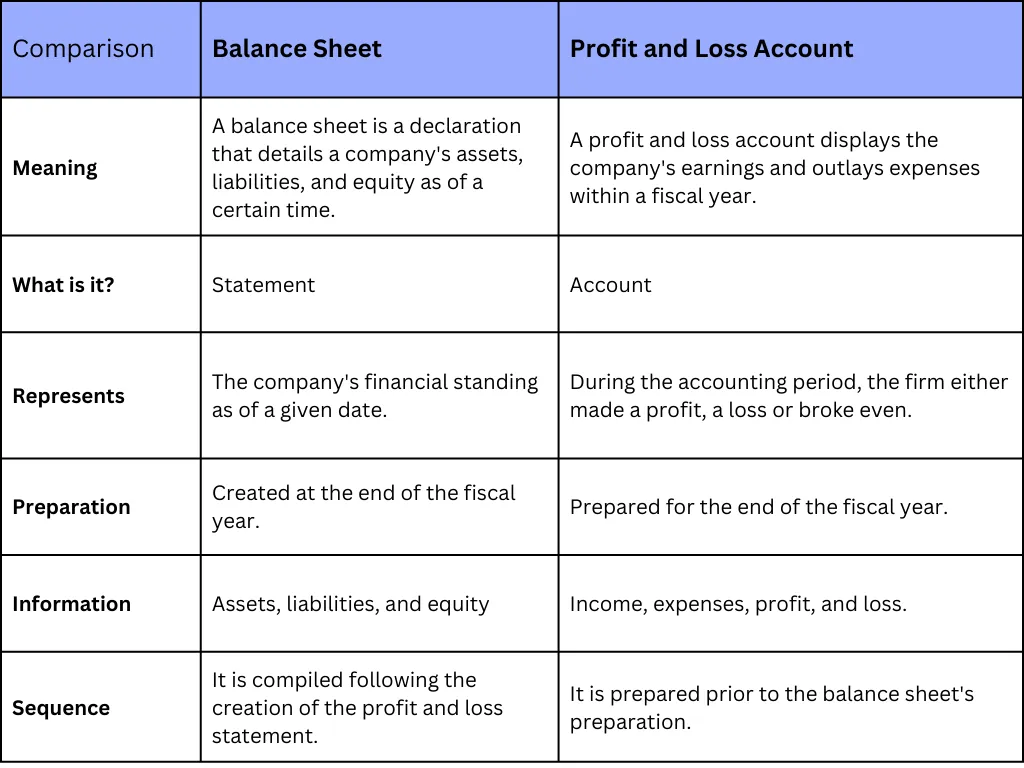

The Differences Between Profit And Loss And Balance Sheet

The following details will clarify how the profit and loss account and balance sheet differ from one another:

1. A balance sheet is a declaration that details the entity's financial situation as of a certain date. As you can see, the Balance Sheet begins with "as at X time" which indicates the specific date on which it was compiled.

On the other hand, the income statement's Profit and Loss Account is only one component. It is also known as a revenue and cost statement. It indicates the company's profitability over a specific period.

2. A balance sheet can be created vertically or horizontally since it is a statement rather than an account. A Profit and Loss Account, however, is a type of account. I'm sure you're wondering:

3. Why is a balance sheet considered a statement as opposed to an account?

A balance sheet is based on the closing balances of the accounts rather than journal entries, which is how an account is generated.

A ledger account also provides a summary of the categorized transactions. A balance sheet, however, does not give a brief explanation. Additionally, whereas the two sides of a ledger account rarely add up, the two sides of a balance sheet almost always do. And for this reason, the account is balanced.

4. The financial situation of the organization is shown on the balance sheet. While the Profit and Loss account details the entity's performance and profitability, including any profit the company, made or losses it incurred throughout the accounting period.

5. When accounts are moved to profit and loss accounts, they are closed, and their identities are lost. Contrarily, accounts that are moved to the balance sheet continue to exist; instead, their balance is carried over to the following accounting year and is regarded as the opening balance.

6. A company's assets, equity, and liabilities are summarized on its balance sheet, while its income and costs are shown in the profit and loss account.

Read more: Troubleshooting mismatching bank balances.

Frequently Asked Questions (FAQ)

1. What is the main difference between a Profit and Loss Statement and a Balance Sheet?

The Profit and Loss Statement (P&L) shows a company’s revenue and expenses over a specific period, indicating whether the company made a profit or incurred a loss. The Balance Sheet, on the other hand, provides a snapshot of the company’s financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity.

2. Why are both the Profit and Loss Statement and Balance Sheet important?

Both reports offer critical insights into a company's financial health. The P&L helps stakeholders understand the company's profitability over time, while the Balance Sheet reveals its financial stability by showing how much the company owns (assets) versus what it owes (liabilities).

3. Can a company have a profit on the Profit and Loss Statement but still show a loss on the Balance Sheet?

No, this is not possible because the Balance Sheet does not show profits or losses directly. Instead, a profit or loss on the P&L affects the equity section of the Balance Sheet. However, a company can show a profit on the P&L while still having a weak Balance Sheet if it has high liabilities or poor asset management.

4. How often should a business prepare a Profit and Loss Statement and a Balance Sheet?

Typically, businesses prepare these statements at the end of each accounting period, which can be monthly, quarterly, or annually. Some businesses also prepare them more frequently for internal review or specific financial planning purposes.

5. What are the key components of a Balance Sheet?

The Balance Sheet consists of three main components:

Assets: What the company owns, including cash, inventory, property, and equipment.

Liabilities: What the company owes, such as loans, accounts payable, and mortgages.

Equity: The owners' claim after liabilities are settled, including retained earnings and shareholders' equity.

6. What are the key components of a Profit and Loss Statement?

The P&L Statement includes:

- Revenue: Total income from sales or services provided.

- Cost of Goods Sold (COGS): Direct costs related to the production of goods or services sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs required to run the business, excluding COGS.

- Net Profit or Loss: The final profit or loss after all expenses, including taxes, have been deducted from the revenue.

7. How do adjustments and accruals impact the Profit and Loss Statement and Balance Sheet?

Adjustments and accruals ensure that income and expenses are recorded in the correct accounting period. They can impact both the P&L and Balance Sheet by ensuring that revenues and expenses are matched accurately, which might lead to the creation of assets or liabilities on the Balance Sheet.

8. What is the role of depreciation in the Balance Sheet and Profit and Loss Statement?

Depreciation is the allocation of the cost of a tangible asset over its useful life. On the P&L, it is recorded as an expense, reducing net profit. On the Balance Sheet, it reduces the asset's book value over time.

9. Can the Balance Sheet show whether a company is profitable?

The Balance Sheet alone does not show profitability. It shows the company’s financial position at a specific point in time. Profitability is determined by analyzing the Profit and Loss Statement.

10. How do the Profit and Loss Statement and Balance Sheet complement each other?

The P&L provides insight into the company's operational efficiency by showing revenues and expenses, while the Balance Sheet provides a broader view of the company’s financial stability and structure by detailing assets, liabilities, and equity. Together, they give a comprehensive picture of a company's financial health.

11. What should I look for when analyzing a Balance Sheet?

Key aspects to analyze include the liquidity of assets, the ratio of liabilities to equity (debt-to-equity ratio), and the overall structure of the company’s finances. Look for a balance between assets and liabilities and consider how these elements change over time.

12. Why is equity important on the Balance Sheet?

Equity represents the owners' claim after all liabilities have been settled. It indicates the net worth of the company and reflects retained earnings, capital contributions, and any other equity transactions. Positive equity suggests financial stability, while negative equity could signal potential financial difficulties.

A balance sheet is, in general, a statement of assets and liabilities. The Profit and Loss Account, in contrast, is an account that displays the period's revenues and expenses. The net result throughout an accounting period is therefore shown in the profit and loss account.

Ready to streamline your financial management? Wafeq offers comprehensive tools to help you easily manage your profit and loss statements and balance sheets.

Ready to streamline your financial management? Wafeq offers comprehensive tools to help you easily manage your profit and loss statements and balance sheets.

.png?alt=media)