What is the concept of fair value in accounting?

Picture this: A tech startup acquires a competitor for 5 million, only to discover months later that the"bargain" was worth 3 million. Meanwhile, a family-owned bakery insists that its secret recipe is priceless until the bank demands a number for its loan application. Both scenarios share one critical question: What's the assets' actual and unbiased worth?

That's where fair value accounting comes in. The financial world's most objective scale for measuring what something is worth in today's market. Let's break down why this concept is the backbone of transparent financial reporting.

What is fair value in accounting?

Fair value is the price you'd get if you sold an asset (or paid to settle a liability) in an orderly transaction between willing parties today, not what you had paid years ago or hope to get tomorrow. It's about current market reality, not historical cost or sentimental value.

Example:

Example:

Your company owns a warehouse that was bought in mid-2010. Today, similar warehouses sell for 2.5 M.

Fair value = $2.5M (even if you'd never sell it).

Definition of Fair Value in International Accounting Standards

Under IFRS 13 (the global standard for fair value measurement), Fair value is defined as "the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date." This means it reflects an exit price (what you’d get if selling now), not an entry price or historical cost, and assumes buyers/sellers are independent, knowledgeable, and acting without pressure. The standard emphasizes using market-based inputs (like stock prices or comparable sales) over entity-specific assumptions, with a three-level hierarchy prioritizing observable data. Essentially, this is how accounting answers: "What’s this worth today in an open, competitive market?"

The Importance of Fair Value in Accounting

Global financial reporting is balanced by eliminating subjective "guess estimates."

How to Calculate Fair Value (With Example)

Calculating fair value typically involves estimating what an asset would sell for in an orderly market transaction under current conditions.

- For traded assets like stocks, fair value is simply the market price (e.g., Tesla shares trading at $250).

Know more about: Current Assets vs. Noncurrent Assets, Simply Explained.

- For non-traded assets, like a private company or property, you might use approaches like:

- Market Approach: Compare similar assets (e.g., valuing a warehouse by analyzing recent sales of comparable buildings in the same area).

- Income Approach: Discount future cash flows. This approach is used for income-generating assets that generate cash flows, such as businesses and real estate.

Fair value formula:

Fair value formula:

Fair Value = Future Cash Flows ÷ (1 + Discount Rate)^Number of Periods.

Example: Valuation of a Rental Property

Example: Valuation of a Rental Property

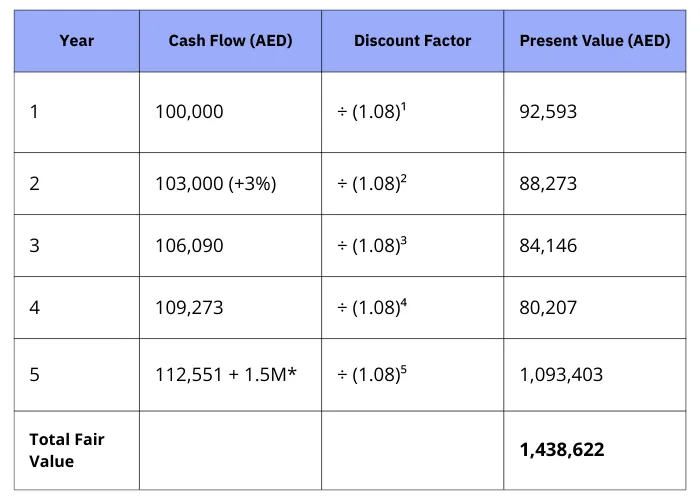

You own an apartment with an annual rental income of AED 100,000, expected to grow at 3% per year. You plan to sell it after 5 years.

The discount rate is 8% (reflecting market risk).

Calculating the fair value of the property:

* The expected sale value of the property in the fifth year is approximately AED 1.5 million.

- Cost approach: Replacement cost less depreciation. This approach is used in calculating fair value when the asset is non-current and does not generate cash flows or when the cost better reflects its correct value than the market value.

Example:

Example:

A company owns a five-year-old printing machine. How do you calculate its fair value?

- For example, a new machine costs AED 500,000 today.

- Assuming the asset's annual depreciation rate is 4%, subtract 20% from the depreciation value to calculate the five-year depreciation rate. Depreciation rate = (500,000 * 20% = 100,000)

- Therefore, the fair value is (500,000 - 100,000) = AED 400,000.

Fair Value vs. Market Value: A Cost Accountant's Perspective

While fair value and market value are related, but they are not identical. Fair value is a theoretical measure under IFRS and GAAP that estimates an asset's price in an orderly transaction between knowledgeable parties, even if no active market exists. It considers multiple valuation approaches (income, cost, or market) and adjusts for illiquidity or unique asset features.

Market value, however, is the actual observable price in a current transaction, reflecting real-time supply/demand—even if the market is distressed or irrational. For example, in a recession fire sale, a factory's market value might drop to AED 10M while its fair value (using discounted cash flows) could remain at AED 15M.

Key Difference: Fair value aims for economic reality; market value captures current sentiment. Cost accountants prioritize fair value for financial reporting to avoid distorting balance sheets with volatile market swings.

FQAs about Fair Value in Accounting

What is the difference between fair value and historical cost?

Fair value represents the current market price of an asset between willing parties, while historical cost records the asset's original purchase price. The fair value fluctuates with market conditions, whereas historical cost remains fixed except in limited cases such as revaluation.

What is the fair value of fixed assets?

The fair value of fixed assets is calculated based on the current market value or replacement cost (for similar assets) minus depreciation. For example, if a machine originally costs 500,000 dirhams but sells for 1 million dirhams today, its fair value would be 1 million (after deducting depreciation, if applicable).

What are the three main types of costs?

- Fixed costs (e.g., rent)

- Variable costs (e.g., raw materials)

- Mixed costs (containing both fixed and variable components)

Simplify fair value accounting and financial reporting with Wafeq, the all-in-one accounting software built for SMEs in the MENA region.

Simplify fair value accounting and financial reporting with Wafeq, the all-in-one accounting software built for SMEs in the MENA region.

.png?alt=media)